Shutterfly 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Property and Equipment

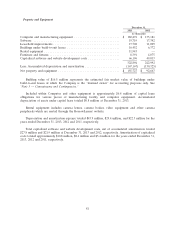

Property and equipment are stated at historical cost, less accumulated depreciation and amortization.

Depreciation and amortization are computed using the straight-line method over the estimated lives of the

assets, generally three to five years, and are allocated between cost of net revenues and operating expenses.

Rental assets are depreciated over their estimated useful lives, generally five to six years as component of

cost of net revenues, to an estimated net realizable value. Leasehold improvements are amortized over

their estimated useful lives, or the lease term if shorter, generally three to ten years. Upon retirement or

sale, the cost and related accumulated depreciation are removed from the balance sheet and the resulting

gain or loss is reflected in operating expenses, except for rental assets, which are recognized in cost of net

revenues. Major additions and improvements are capitalized, while replacements, maintenance and repairs

that do not extend the life of the asset are charged to expense as incurred.

Software and Website Development Costs

The Company capitalizes eligible costs associated with website development and software developed

or obtained for internal use. Accordingly, the Company expenses all costs that relate to the planning and

post implementation phases. Payroll and payroll related costs and stock based compensation incurred in

the development phase are capitalized and amortized over the product’s estimated useful life, generally

three years. Costs associated with minor enhancements and maintenance for the Company’s websites are

expensed as incurred.

Long-Lived Assets

The Company reviews long-lived assets for impairment whenever events or changes in circumstances

indicate that the carrying amount of an asset may not be recoverable. Recoverability is measured by

comparison of the carrying amount to the future net cash flows which the assets are expected to generate.

If such assets are considered to be impaired, the impairment to be recognized is measured by the amount

by which the carrying amount of the assets exceeds the projected discounted future cash flows arising from

the asset using a discount rate determined by management to be commensurate with the risk inherent to

the Company’s current business model.

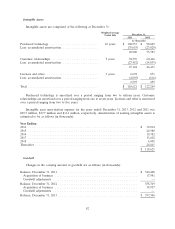

Goodwill and Intangible Assets

Goodwill represents the excess of the purchase price over the fair value of the net tangible and

identifiable intangible assets acquired in a business combination. Intangible assets resulting from the

acquisition of entities accounted for using the purchase method of accounting are estimated by

management based on the fair value of assets received. Intangible assets are amortized on a straight-line

basis over the estimated useful lives which range from one to sixteen years, and the amortization is

allocated between cost of net revenues and operating expenses. Goodwill and intangible assets with

indefinite lives are not subject to amortization, but are tested for impairment on an annual basis during the

fourth quarter or whenever events or changes in circumstances indicate the carrying amount of these assets

may not be recoverable.

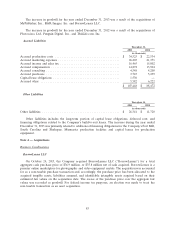

For the Company’s annual goodwill impairment analysis, the Company operates under one reporting

unit. The Company determined the fair value of its reporting unit based on its enterprise value. The

Company performed step one of the annual goodwill impairment test for years ended December 31, 2013

and 2012. The enterprise value exceeded the carrying value for both periods and accordingly, no

impairment was recorded.

75