Red Lobster 2000 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2000 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DARDEN RESTAURANTS

acquiring company having a value equal to two times

the exercise price of the right. The rights are redeemable

by the Company’s Board in certain circumstances and

expire on May 24, 2005.

Note 12

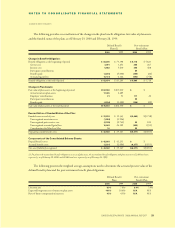

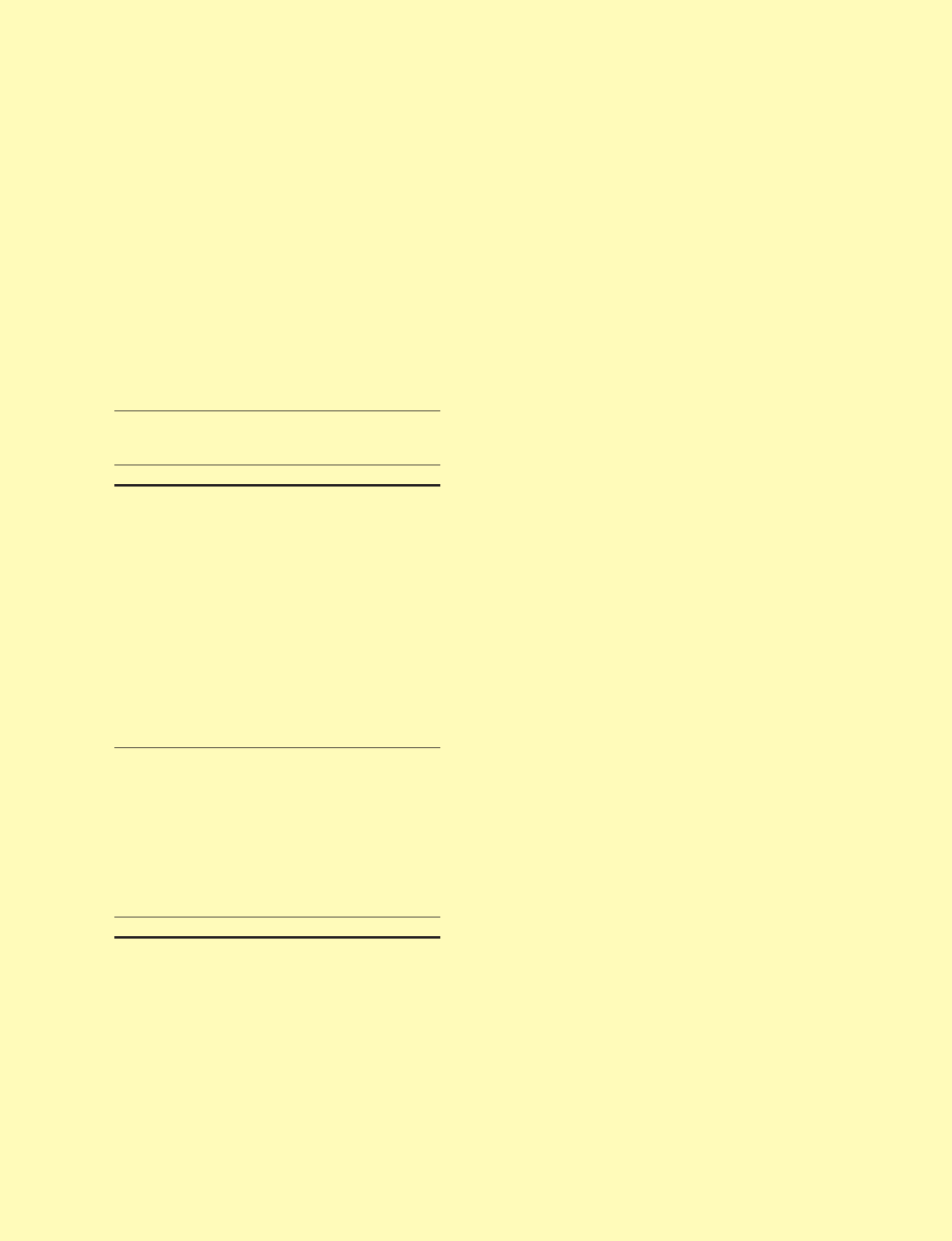

Interest, Net

The components of interest, net are as follows:

Fiscal Year

2000 1999 1998

Interest expense $24,999 $21,015 $21,527

Capitalized interest (1,910) (593) (1,018)

Interest income (701) (882) (425)

Interest, net $22,388 $19,540 $20,084

Capitalized interest was computed using the

Company’s borrowing rate. The Company paid $19,834,

$16,356 and $17,235 for interest (net of amount

capitalized) in 2000, 1999 and 1998, respectively.

Note 13

Leases

An analysis of rent expense incurred under operating

leases is as follows: Fiscal Year

2000 1999 1998

Restaurant minimum rent $38,818 $38,866 $39,140

Restaurant percentage rent 2,183 1,853 1,707

Restaurant equipment

minimum rent 8,267 8,511 3,465

Restaurant rent averaging

expense (473) 13 (121)

Transportation equipment 1,946 1,856 2,169

Office equipment 1,090 1,012 990

Office space 597 505 436

Warehouse space 227 215 217

Total rent expense $52,655 $52,831 $48,003

Minimum rental obligations are accounted for on

a straight-line basis over the term of the lease. Percentage

rent expense is generally based on sales levels or changes

in the Consumer Price Index. Most leases require pay-

ment of property taxes, insurance and maintenance

costs in addition to the rent payments. The annual non-

cancelable future lease commitments for each of the five

years subsequent to May 28, 2000 and thereafter are:

$49,460 in 2001; $45,948 in 2002; $38,795 in 2003;

$27,519 in 2004; $22,215 in 2005; and $71,828 there-

after, for a cumulative total of $255,765.

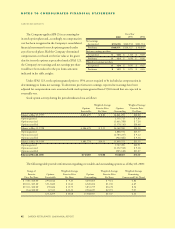

Note 14

Retirement Plans

Substantially all of the Company’s employees are eligi-

ble to participate in a retirement plan. The Company’s

salaried employees are eligible to participate in a post-

retirement benefit plan.

DEFINED BENEFIT PLANS AND

POST-RETIREMENT BENEFIT PLAN

The Company sponsors defined benefit pension plans

for salaried employees with various benefit formulas and

a group of hourly employees with a frozen level of bene-

fits. The Company also sponsors a contributory plan

that provides health-care benefits to its salaried retirees.

38 DARDEN RESTAURANTS 2000 ANNUAL REPORT