Red Lobster 2000 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2000 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 DARDEN RESTAURANTS 2000 ANNUAL REPORT

Darden Restaurants, Inc. (Darden or the Company)

operates 1,139 Red Lobster, Olive Garden, Bahama

Breeze and Smokey Bones restaurants in the U.S. and

Canada and licenses 35 restaurants in Japan. All of the

restaurants in the U.S. and Canada are operated by the

Company with no franchising.

This discussion should be read in conjunction

with the business information and the consolidated

financial statements and related notes found elsewhere

in this report. Darden's fiscal year ends on the last

Sunday in May.

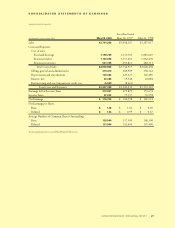

Revenues

Total revenues in 2000 (52 weeks) were $3.70 billion,

a seven percent increase from 1999 (52 weeks). Total

revenues in 1999 were $3.46 billion, a five percent

increase from 1998 (53 weeks).

Costs and Expenses

Food and beverage costs for 2000 were 32.4 percent of

sales, a decrease of 0.4 percentage points from 1999 and

a decrease of 0.6 percentage points from 1998. The lower

level of food and beverage costs for 2000, as a percent-

age of sales, is primarily attributable to pricing, margin

improving initiatives such as waste reduction, and a

lower-margin promotion run by Red Lobster during the

first quarter last year.

Restaurant labor decreased in 2000 to 31.9 per-

cent of sales compared to 32.3 percent of sales in 1999

and 1998 primarily due to efficiencies resulting from

higher sales volumes.

Restaurant expenses (primarily lease expenses,

property taxes, utilities and workers’ compensation

costs) decreased in 2000 to 14.1 percent of sales com-

pared to 14.3 percent in 1999 and 14.7 percent in

1998 primarily as a result of higher sales volumes and

the fixed component of these expenses which are not

impacted by higher sales volumes.

Selling, general and administrative expenses

decreased in 2000 to 10.3 percent of sales compared to

10.4 percent in 1999 and 10.9 percent in 1998. The

decreases in 2000 and 1999 in comparison to 1998 are

principally a result of reduced marketing expenses as a

percent of sales offset by additional labor costs associ-

ated with new concept expansion and development.

Depreciation and amortization expense of 3.5 per-

cent of sales in 2000 decreased from 3.6 percent in

1999 and 3.8 percent in 1998 primarily as a result of

increased sales levels. Interest expense was comparable

from year to year at 0.6 percent of sales.

Income From Operations

Pre-tax earnings before net restructuring and asset

impairment credit increased by 29.2 percent in 2000 to

$268.0 million, compared to $207.4 million in 1999

and $153.7 million in 1998. The increase in 2000 was

mainly attributable to annual same-restaurant sales

increases in the U.S. for both Red Lobster and Olive

Garden totaling 7.6 percent and 7.2 percent, respectively.

The increase in 1999 was mainly attributable to annual

same-restaurant sales increases in the U.S. for both Red

Lobster and Olive Garden totaling 7.4 percent and 9.0

percent, respectively. Red Lobster and Olive Garden have

enjoyed ten and 23 consecutive quarters of U.S. same-

restaurant sales increases, respectively.

Provision for Income Taxes

The effective tax rate for 2000 before net restructuring

and asset impairment credit was 35.4 percent com-

pared to 34.8 percent in 1999 and 33.8 percent in

1998. The increase in the effective tax rates each year is

a result of higher annual pre-tax earnings.

MANAGEMENT’S DISCUSSION

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION

DARDEN RESTAURANTS