Red Lobster 2000 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2000 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

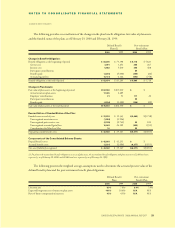

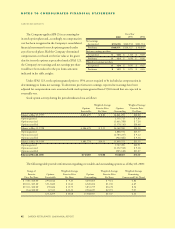

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DARDEN RESTAURANTS

certain Darden inventory items are sold to these com-

panies at a predetermined price when they are shipped

to their storage facilities. These items are repurchased at

the same price by Darden when the inventory is subse-

quently delivered to Company restaurants. These trans-

actions do not impact the consolidated statements of

earnings. Receivables from national distribution com-

panies amounted to $24,692 and $12,022 at May 28,

2000, and May 30, 1999, respectively.

Note 3

Restructuring and

Asset Impairment Credit, Net

Darden recorded asset impairment charges of $2,629

and $158,987 in 2000 and 1997, respectively, repre-

senting the difference between fair value and carrying

value of impaired assets. The asset impairment charges

relate to low-performing restaurant properties and

other long-lived assets, including restaurants that have

been closed. Fair value is generally determined based

on appraisals or sales prices of comparable properties.

In connection with the closing of certain restaurant

properties, the Company recorded other restructuring

expenses of $70,900 in 1997. The related liabilities are

included in other current liabilities in the accompany-

ing consolidated balance sheets and were established to

accrue for estimated carrying costs of buildings and

equipment prior to disposal, employee severance costs,

lease buy-out provisions and other costs associated with

the restructuring action. All restaurant closings under

this restructuring action have been completed. The

remaining restructuring actions, including disposal of

the closed owned properties and the lease buy-outs

related to the closed leased properties, are expected to

be substantially completed during 2001.

During 2000 and 1999, the Company reversed

portions of its 1997 restructuring liability totaling $8,560

and $8,461, respectively. The reversals primarily resulted

from favorable lease terminations in 2000 and the

Company’s decision in 1999 to close fewer restaurants

than identified for closure as part of the restructuring

action. No restructuring or asset impairment expense or

credit was charged to operating results during 1998.

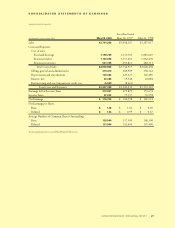

The components of the restructuring and asset

impairment credit, net and the after-tax and earnings

per share effects of these items for 2000 and 1999 are

as follows:

Fiscal Year

2000 1999

Carrying costs of buildings and

equipment prior to disposal and

employee severance costs $$(3,907)

Lease buy-out provisions (8,560) (4,554)

Subtotal (8,560) (8,461)

Impairment of restaurant properties 2,629

Total restructuring and asset

impairment credit, net (5,931) (8,461)

Less related income tax effect 2,308 3,236

Restructuring and asset impairment

credit, net, net of income taxes (3,623) $(5,225)

Earnings per share effect –

basic and diluted $ (0.03) $ (0.04)

As of May 28, 2000, approximately $39,800 of

carrying, employee severance and lease buy-out costs

associated with the 1997 restructuring had been paid

and charged against the restructuring liability.

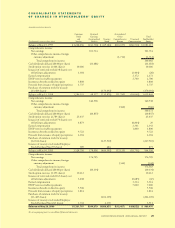

A summary of restructuring liability activity for

2000 is as follows:

Balance at May 30, 1999 $ 37,139

Non-cash Adjustments:

Restructuring credit (8,560)

Reclassification of asset impairment

(described below) (12,000)

Cash Payments:

Carrying costs and employee severance payments (2,744)

Lease payments including lease buy-outs (5,271)

Balance at May 28, 2000 $ 8,564

Asset impairment charges of $12,000 included

in the May 30, 1999 restructuring liability have been

reclassified to reduce the carrying value of land for all

periods presented. This reclassification related to asset

impairment charges recorded in 1997 for long-lived

assets associated with Canadian restaurants.

34 DARDEN RESTAURANTS 2000 ANNUAL REPORT