Red Lobster 2000 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2000 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE INDUSTRY

Casual dining’s current

business climate is

strong, with demand

exceeding supply.

The current supply and demand dynamics in casual dining are

excellent. Traffic growth has remained strong while unit growth

has tempered, coming off the overheated levels of the mid-1990s.

The result has been a healthy balance, with the strongest operators

enjoying more traffic per unit.

Two factors enhance this favorable climate. In a tight labor

market, only employers of choice will find the capable employees

to successfully staff unit expansion. And rising interest rates and

disappointing performances by venture restaurant companies

in the 1990s make it challenging for all but the most successful

companies to secure capital to fund expansion.

DARDEN

Red Lobster and

Olive Garden are both

outperforming the

casual dining industry.

Red Lobster and Olive Garden have had same-restaurant sales

growth for 10 and 23 quarters, respectively. By staying fresh and

relevant to today’s consumers, each has outpaced the industry.

Much of this success stems from Darden’s reliance on constant

consumer research. Capitalizing on this research and the fact that

seafood has nearly universal appeal, Red Lobster differentiates

itself from the competition by offering unique regional dishes;

traffic-building promotions like its signature Lobsterfest; well-

trained, highly motivated crew members; remodeled bar areas;

and a lively, festive dining atmosphere.

Olive Garden has become a family of local restaurants providing

a genuine Italian dining experience to guests. It serves approachable,

fresh, high-quality Italian food, complemented by a great glass of

wine, in revitalized restaurants and in new restaurants with the

exciting, home-like Tuscan Farmhouse design.

Olive Garden also benefits from a unique partnership with

Rocca delle Macie, one of Tuscany’s most respected family-owned

wineries. Together they have established the Culinary Institute of

Tuscany, where Olive Garden chefs share ideas with their Italian

counterparts and create new authentic Italian dishes, while also

experiencing a total immersion in Italian culture.

Darden’s consumer research guides the Company’s search

for new concepts and appealing acquisitions. Bahama Breeze

and Smokey Bones were created through this process.

18 DARDEN RESTAURANTS 2000 ANNUAL REPORT

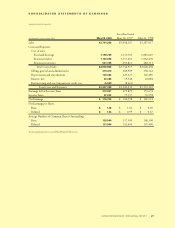

Supply vs. Demand

(Percentages)

94 95 96 97 98 99

Darden Fiscal Year

Total Traffic

Growth

Total Unit

Growth

Red Lobster

Same-Restaurant Sales Growth vs. The Industry

(Percentages)

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

98 99 00

Knapp Track (excluding Red Lobster and Olive Garden)

Sources: Unit Growth from RECOUNT

Traffic Growth from CREST

5.2

3.2

6.8

8.8

8.1

-0.2

6.2

3.7

4.6

6.2 6.3

4.9

1.9

-0.2

2.8

5.3

11.6

5.4

6.8

5.4

4.0

8.2

5.0

13.1

3.