Red Lobster 2000 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2000 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

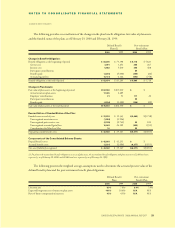

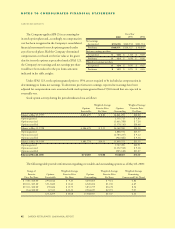

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DARDEN RESTAURANTS

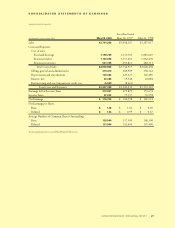

Note 5

Land, Buildings and Equipment

The components of land, buildings and equipment are

as follows:

May 28, 2000 May 30, 1999

Land $ 409,069 $ 387,050

Buildings 1,425,557 1,344,625

Equipment 680,178 647,687

Construction in progress 75,027 38,859

Total land, buildings

and equipment 2,589,831 2,418,221

Less accumulated depreciation (1,011,290) (956,686)

Net land, buildings

and equipment $1,578,541 $1,461,535

Note 6

Other Assets

The components of other assets are as follows:

May 28, 2000 May 30, 1999

Prepaid pension $ 42,893 $ 41,253

Prepaid interest and loan costs 20,312 22,391

Liquor licenses 17,599 17,657

Intangible assets 11,211 10,504

Prepaid equipment maintenance 4,103 6,565

Miscellaneous 6,304 6,018

Total other assets $102,422 $104,388

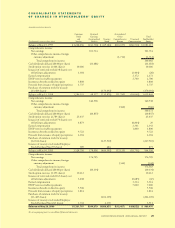

Note 7

Short-term Debt

Short-term debt at May 28, 2000 and May 30, 1999,

consisted of $115,000 and $23,500 of unsecured

commercial paper borrowings with original maturities

of one month or less, and interest rates ranging from

6.36 percent to 6.75 percent and 5.05 percent to

5.80 percent, respectively.

Note 8

Long-term Debt

The components of long-term debt are as follows:

May 28, 2000 May 30, 1999

10-year notes and 20-year

debentures as described below $250,000 $250,000

ESOP loan with variable rate of

interest (6.87 percent at May 28,

2000), due December 31, 2018 52,600 60,200

Other 5,160 7,546

Total long-term debt 307,760 317,746

Less issuance discount (1,174) (1,295)

Total long-term debt less

issuance discount 306,586 316,451

Less current portion (2,513) (2,386)

Long-term debt, excluding

current portion $304,073 $314,065

In January 1996, the Company issued $150,000

of unsecured 6.375 percent notes due in February 2006

and $100,000 of unsecured 7.125 percent debentures

due in February 2016. The proceeds from the issuance

were used to refinance commercial paper borrowings.

Concurrent with the issuance of the notes and debentures,

the Company terminated, and settled for cash, interest-

rate swap agreements with notional amounts totaling

$200,000, which hedged the movement of interest

rates prior to the issuance of the notes and debentures.

The cash paid in terminating the interest-rate swap

agreements is being amortized to interest expense over

the life of the notes and debentures. The effective

annual interest rate is 7.57 percent for the notes and

7.82 percent for the debentures, after consideration of

loan costs, issuance discounts and interest-rate swap

termination costs.

36 DARDEN RESTAURANTS 2000 ANNUAL REPORT