Qantas 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

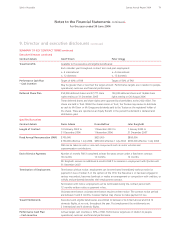

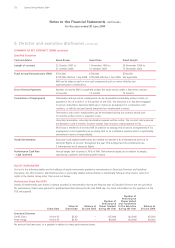

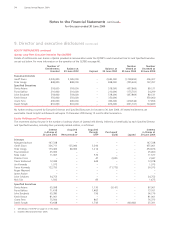

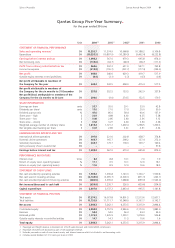

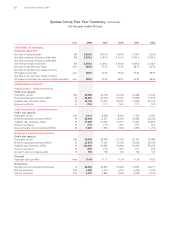

Qantas Group Five-Year Summary

for the year ended 30 June

Qantas Annual Report 2004 81Spirit of Australia

Unit 20041,2 20031,2 20021,2 2001 2000

STATEMENT OF FINANCIAL PERFORMANCE

Sales and operating revenue3$M 11,353.7 11,374.9 10,968.8 10,188.2 9,106.8

Expenditure $M (10,255.5) (10,807.9) (10,289.5) (9,492.4) (8,232.8)

Earnings before interest and tax $M 1,098.2 567.0 679.3 695.8 874.0

Net borrowing costs $M (133.6) (64.7) (48.3) (98.7) (111.2)

Profit from ordinary activities before tax $M 964.6 502.3 631.0 597.1 762.8

Income tax expense $M (315.8) (155.7) (201.7) (177.4) (244.9)

Net profit $M 648.8 346.6 429.3 419.7 517.9

Outside equity interests in net (profit)/loss $M (0.4) (3.1) (1.3) (4.3) (0.6)

Net profit attributable to members of

the Company for the year $M 648.4 343.5 428.0 415.4 517.3

Net profit attributable to members of

the Company for the six months to 31 December $M 357.8 352.5 153.5 262.9 337.8

Net profit/(loss) attributable to members of the

Company for the six months to 30 June $M 290.6 (9.0) 274.5 152.5 179.5

SHARE INFORMATION

Earnings per share cents 35.7 20.0 29.1 33.0 42.8

Dividends per share4cents 17.0 17.0 17.0 20.0 59.0

Dividend payout ratio % 47.6 85.0 58.4 60.6 137.9

Share price – high $ 3.81 4.88 4.92 4.25 5.28

Share price – low $ 3.08 2.85 2.60 2.36 3.12

Share price – closing $ 3.52 3.27 4.60 3.50 3.38

Weighted average number of ordinary shares M 1,815.4 1,721.2 1,469.4 1,258.5 1,209.3

Net tangible asset backing per share $ 3.07 2.89 2.61 2.51 2.34

EARNINGS BEFORE INTEREST AND TAX

International airline operations $M 397.8 221.6 202.8 458.7 374.8

Domestic airline operations $M 465.7 165.7 298.2 127.4 272.0

Subsidiary businesses $M 234.7 179.7 178.3 109.7 169.4

Items previously shown as abnormal $M ––––57.8

Earnings before interest and tax $M 1,098.2 567.0 679.3 695.8 874.0

PERFORMANCE INDICATORS

Interest cover times 8.2 8.8 14.1 7.0 7.9

Return on equity (excl. operating leases) % 11.1 6.5 10.1 12.6 18.1

Return on equity (incl. operating leases) % 11.0 8.9 12.0 10.6 18.3

STATEMENT OF CASH FLOWS

Net cash provided by operating activities $M 1,999.4 1,290.8 1,143.3 1,100.7 1,599.8

Net cash used in investing activities $M (2,169.5) (2,995.7) (2,306.1) (871.3) (262.7)

Net cash provided by/(used in) financing activities $M (480.5) 2,935.6 1,688.8 (659.0) (1,542.0)

Net increase/(decrease) in cash held $M (650.6) 1,230.7 526.0 (429.6) (204.9)

Capital expenditure $M 2,007.0 3,137.2 2,463.4 995.5 1,141.8

STATEMENT OF FINANCIAL POSITION

Total assets $M 17,574.2 16,973.8 14,801.5 12,513.6 12,007.1

Total liabilities $M 11,733.9 11,711.7 10,548.0 9,197.7 9,142.7

Net assets $M 5,840.3 5,262.1 4,253.5 3,315.9 2,864.4

Contributed equity $M 3,994.9 3,757.9 2,946.6 2,173.0 1,882.0

Reserves $M 54.4 54.0 56.3 54.3 54.0

Retained profits $M 1,776.3 1,435.9 1,239.1 1,078.0 926.8

Outside equity interests in controlled entities $M 14.7 14.3 11.5 10.6 1.6

Total equity $M 5,840.3 5,262.1 4,253.5 3,315.9 2,864.4

1 Passenger and freight revenue is disclosed net of both sales discount and interline/IATA commission.

2 Passenger recoveries are disclosed as part of net passenger revenue.

3 Excludes proceeds on sale of non-current assets, and interest revenue which is included in net borrowing costs.

4 Includes special dividend of 37.0 cents per share in 2000.