Qantas 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 Qantas Annual Report 2004

Notes to the Financial Statements continued

for the year ended 30 June 2004

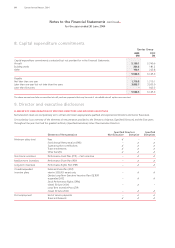

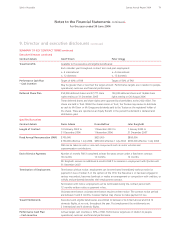

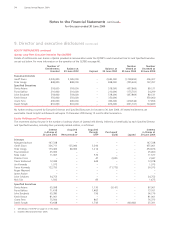

9. Director and executive disclosures continued

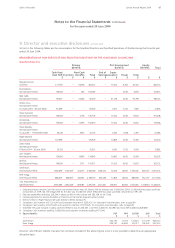

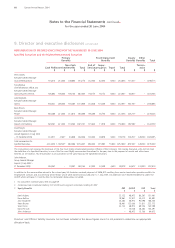

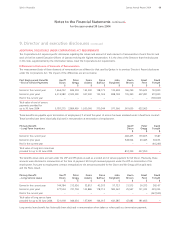

ELEMENTS OF REMUNERATION OF SPECIFIED DIRECTORS AND SPECIFIED EXECUTIVES continued

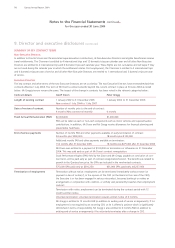

Description Rationale

POST EMPLOYMENT BENEFITS

End of Service Payments

Executive Directors and Specified Executives are entitled to service End of service payments are considered effective retention

payments on termination, generally based on FAR, as set out in mechanisms. These are payable upon cessation of employment

individual employment contracts. and provide compensation for constraints regarding working for

a competitor for up to 12 months.

Superannuation Contributions

Statutory and salary sacrifice superannuation payments made on Statutory requirement.

behalf of the Directors and Specified Executives.

Travel Entitlements

See commentary on travel entitlements under non-cash benefits on page 65.

EQUITY BENEFITS

Deferred Share Plan (DSP)

The DSP Terms & Conditions were approved by Shareholders The provision of equity benefits establishes a link between

on 17 October 2002. The DSP governs the provision of equity shareholder value creation, financial performance and executive

benefits. remuneration.

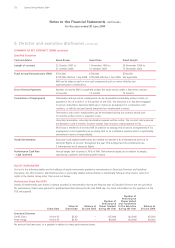

Performance Share Plan (PSP)1

Deferred shares are awarded, with the value being a percentage The performance condition aligns remuneration and growth in

of FAR, based on performance against balanced scorecard conditions shareholder value.

relating to customer, operational, people and financial performance.

Shares are held in trust and are subject to holding locks. Upon

expiry of the relevant holding lock, shares will be transferred to

the Executive. If the Executive terminates employment before the

holding lock is lifted, the shares are forfeited.

Performance Rights Plan (PRP)

Executive Directors and Specified Executives may be granted rights The performance condition of target RoTGA was chosen in 2003

to acquire shares in Qantas at a future date for no payment. Vesting as it measures financial performance that reflects an appropriate

is based on the achievement of annual RoTGA targets over the return on capital. This aligns remuneration and growth in

three years to 30 June 2006. Vested rights may be converted into shareholder value.

ordinary shares after three years. If the target is not met or the

Executive ceases employment prior to 30 June 2006, all of the Future grants will be assessed against a relative TSR performance

rights granted will lapse. condition.

Qantas Long-Term Executive Incentive Plan (QLTEIP) – suspended in 2002

QLTEIP granted entitlements to unissued shares in Qantas in the This performance condition aligns remuneration and growth in

years ended 30 June 2000 and 2001. Vesting is based on Qantas shareholder value.

Relative Total Shareholder Return (TSR) compared to ASX 200

entities and global airlines. Entitlements vest between three and

five years following award date and are conditional on the Executive

remaining employed. To the extent that Entitlements vest, they may

be converted into ordinary shares within eight years of the grant

date in proportion to the gain in share price after which entitlements

will lapse.

1 The Board can exercise its discretion to adjust the PCP or PSP if the company does not meet its target as approved by the Board. This discretionary element

is in place to take into account adverse external factors that may impact the airline. The rationale for this is the Executive Directors and Specified Executives

have no control over external global events, however, they are accountable for the ability of the airline to cope with external events. To date, the Board has

not exercised this discretion in relation to any of the plans in operation.