Qantas 2004 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2004 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

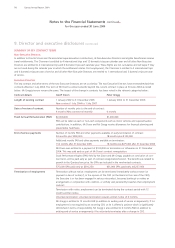

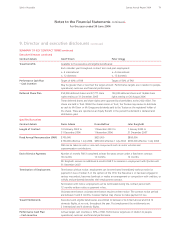

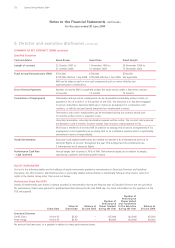

10. International Financial Reporting Standards continued

KEY DIFFERENCES BETWEEN AUSTRALIAN GAAP AND IFRS continued

Impairment of Assets

Qantas is considering the application of AASB 136 “Impairment of Assets” to the valuation of assets. Under IFRS, assets are tested for

impairment on the basis of their ability to generate independent cash inflows from continuing use. If assets do not generate cash flows

they may be aggregated into groups for the purposes of determining the smallest identifiable group of assets that generate cash inflows

which are largely independent. Aircraft do not directly generate cash flows as passenger revenue is derived from the sale of seats on flights

rather than seats on particular aircraft. The aggregation of aircraft cashflows is therefore performed on the basis of route groupings.

Impairment testing upon transition to IFRS is required. The financial effect of the change is not expected to result in significant impairment

losses upon transition. The impact on future financial years is dependent on the cash flows generated by each grouping of assets and is

therefore unable to be determined.

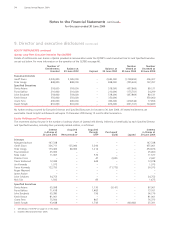

11. Events subsequent to balance date

With the exception of the declaration of a final ordinary dividend of 9.0 cents per share ($166.1 million) subsequent to balance date

(refer Note 4), there has not arisen in the interval between the end of the financial year and the date of this Report, any item, transaction

or event of a material and unusual nature likely, in the opinion of the Directors, to significantly affect the operations of the Qantas Group,

the results of those operations or the state of affairs of the Qantas Group, in this financial year or in future financial years.

Qantas Annual Report 2004 77Spirit of Australia

Notes to the Financial Statements continued

for the year ended 30 June 2004