Qantas 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors’ Report continued

for the year ended 30 June 2004

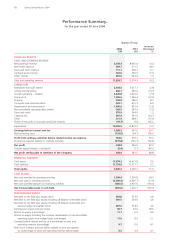

SHARE ENTITLEMENTS continued

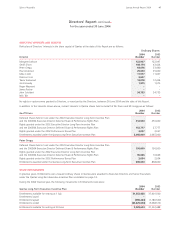

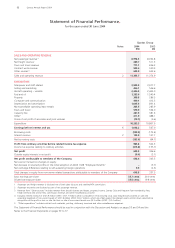

The following Entitlements were outstanding at 30 June 2004:

Number of Entitlements1

Value at

Exercise Grant Net Vested Unvested Total Net Vested Unvested Total

Expiry Date Price Date22004 2004 2004 2003 2003 2003

17 Nov 07 $4.99 $1.13 4,710,850 597,150 5,308,000 5,068,512 642,488 5,711,000

24 Nov 08 $3.44 $0.82 22,833,169 4,457,363 27,290,532 – 29,600,000 29,600,000

20 Feb 09 $3.62 $0.77 635,869 124,131 760,000 – 760,000 760,000

06 Dec 09 $3.25 $1.14 – 350,000 350,000 – 350,000 350,000

28,179,888 5,528,644 33,708,532 5,068,512 31,352,488 36,421,000

1 The Entitlements do not allow the holder to participate in any share issue of Qantas. No dividends are payable on Entitlements.

2 The estimated value per Entitlement at grant date disclosed above is calculated using the Black-Scholes Option Valuation Methodology.

REMUNERATION REPORT

Details of the nature and amount of each major element of the remuneration of each Director of Qantas and each of the five named

Executive Officers of Qantas and the Qantas Group are set out in Note 9 to the financial statements.

I

n the year, a detailed Australian Accounting Standard AASB 1046 was issued, effective for the 30 June 2004 year, dealing with the

disclosure of Director and Executive remuneration. The calculation basis and disclosure requirements of Director and Executive remuneration

under the Corporations Act differ in some aspects from the new Accounting Standard. To ensure clarity for the users of the financial report

in understanding the nature and amounts of remuneration to Directors and Executives, the Corporations Act requirements and Accounting

Standard requirements are included in Note 9 to the financial statements. Differences between the two sets of requirements have been

clearly identified.

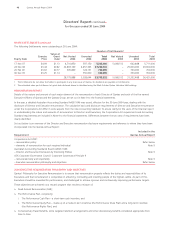

Set out below is an overview of the Director and Executive remuneration disclosure requirements and reference to where they have been

incorporated into the Qantas Annual Report:

Included in the

Requirement Qantas Annual Report

Corporations Act 2001

– remuneration policy Refer below

– elements of remuneration for each required individual Note 9

Australian Accounting Standards Board (AASB) 1046

– Director and Executive Disclosures by Disclosing Entities Note 9

ASX Corporate Governance Council: Corporate Governance Principle 9

– remunerate fairly and responsibly Note 9

– Executive remuneration philosophy and objectives Refer below

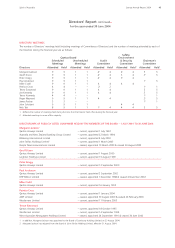

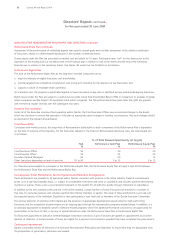

2004 EXECUTIVE REMUNERATION PHILOSOPHY AND OBJECTIVES

Qantas’ Philosophy for Executive Remuneration is to ensure that remuneration properly reflects the duties and responsibilities of its

Executives and that remuneration is competitive in attracting, motivating and retaining people of the highest calibre. As part of this,

Executives should be rewarded for performance, and challenged to achieve rigorous and continuously improving performance targets.

These objectives are achieved via a reward program that involves a mixture of:

Fixed Annual Remuneration (FAR);

The Performance Plan, comprising:

i. The Performance Cash Plan – a short-term cash incentive; and

ii. The Performance Equity Plan – made up of a medium-term incentive (the Performance Share Plan) and a long-term incentive

(the Performance Rights Plan); and

Concessionary Travel Benefits, some targeted retention arrangements and other discretionary benefits considered appropriate from

time to time.

48 Qantas Annual Report 2004