Qantas 2001 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2001 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

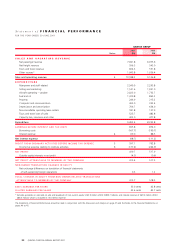

p44 QANTAS CONCISE ANNUAL REPORT 2001

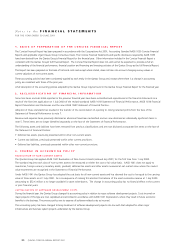

Notes to the FINANCIAL STATEMENTS (continued)

FOR THE YEAR ENDED 30 JUNE 2001

QANTAS GROUP

2001 2000

$M $M

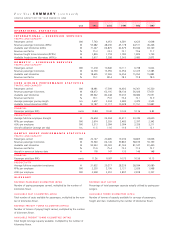

10. SEGMENT INFORMATION (continued)

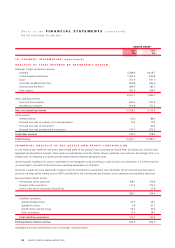

ANALYSIS OF TOTAL REVENUE BY GEOGRAPHIC REGION

Passenger, freight and services revenue

Australia 4,788.9 4,618.7

United Kingdom and Europe 1,003.3 855.8

Japan 761.6 631.0

South East Asia/North East Asia 830.8 646.0

Americas and the Pacific 989.9 783.5

Other regions 392.6 308.7

8,767.1 7,843.7

Other operating revenue

Tours and travel revenue 604.3 551.8

Miscellaneous revenue 816.8 711.3

Sales and operating revenue 10,188.2 9,106.8

Other revenue

Interest revenue 69.0 88.5

Proceeds from sale of property, plant and equipment 16.4 10.3

Proceeds from sale of investments –60.4

Proceeds from sale and leaseback transactions 147.5 819.0

Total other revenue 232.9 978.2

Total revenue 10,421.1 10,085.0

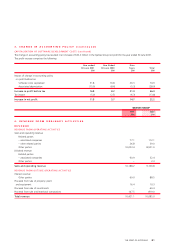

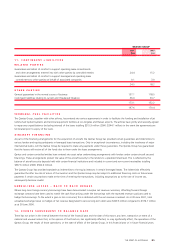

SEGMENTAL ANALYSIS OF NET ASSETS AND PROFIT CONTRIBUTION

For the financial year ended 30 June 2001, the principal assets of the Qantas Group comprised the aircraft fleet, all, except one, of which were

registered and domiciled in Australia. These assets are used flexibly across the Qantas Group’s worldwide route network. Accordingly, there is no

suitable basis for allocating such assets and the related liabilities between geographic areas.

Operating profit resulting from turnover generated in each geographic area according to origin of sale is not disclosed as it is neither practical

nor meaningful to allocate the Qantas Group’s operating expenditure on that basis.

Disclosure is made of a more appropriate measure of profit contributions in accordance with the Qantas Group’s internal reporting system,

being the earnings before interest and tax (EBIT) contributed by the international and domestic airline operations and subsidiary operations.

Earnings before interest and tax

International airline operations 458.7 374.8

Domestic airline operations 127.4 272.0

Profit on the sale of investment EQUANT NV – 57.8

586.1 704.6

Subsidiary operations

Qantas Holidays Group 33.5 28.1

QantasLink Group 6.4 67.2

Qantas Flight Catering Group 54.3 39.4

Other subsidiaries 15.5 34.7

Total subsidiary operations 109.7 169.4

Earnings before interest and tax 695.8 874.0

Intersegment pricing is determined on an arm’s-length commercial basis.