Qantas 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

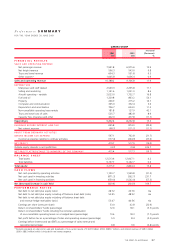

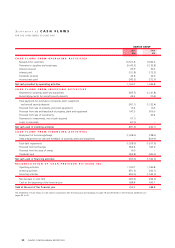

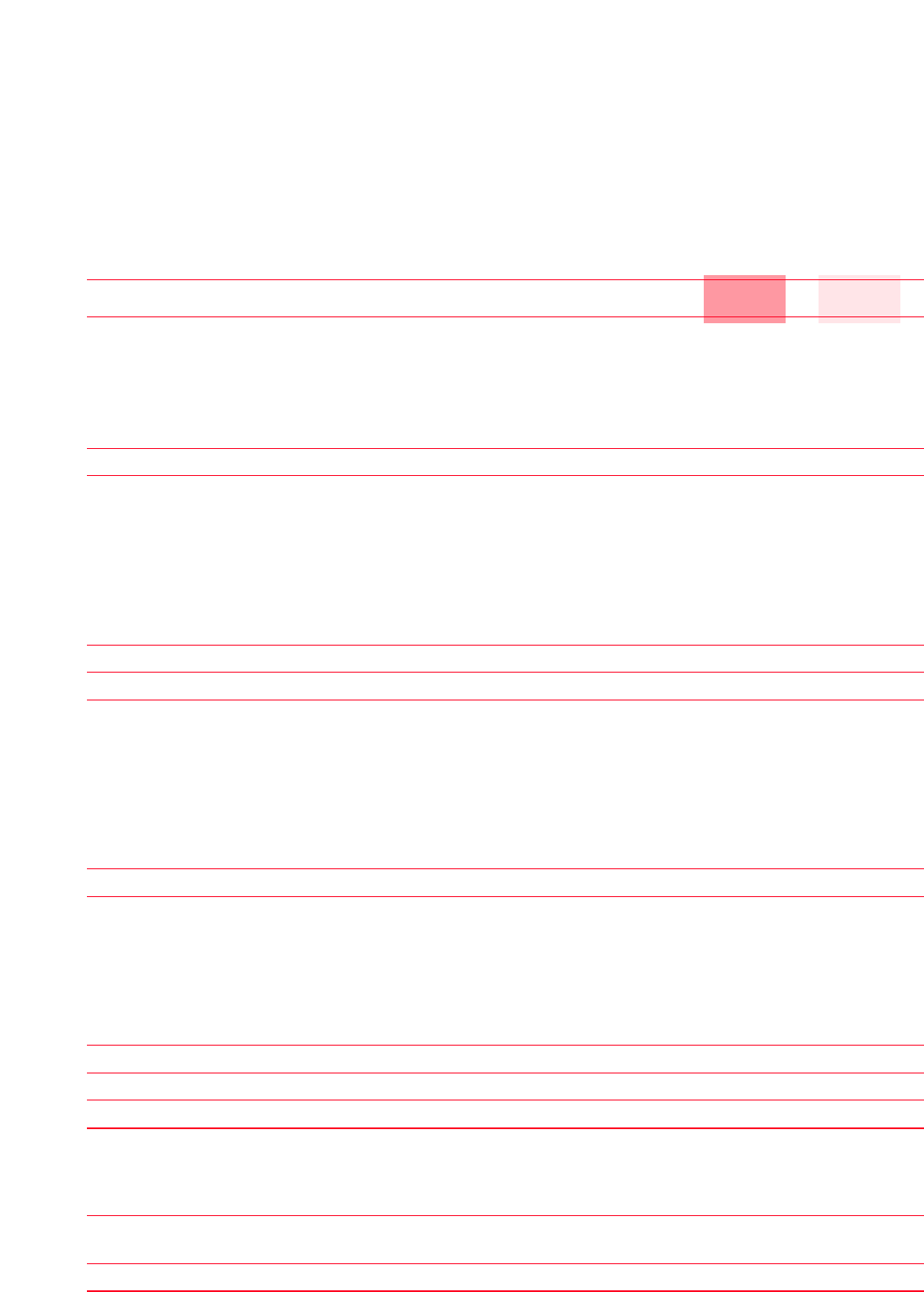

p36 QANTAS CONCISE ANNUAL REPORT 2001

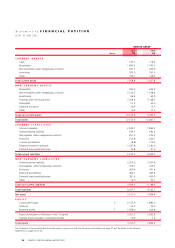

Statement of FINANCIAL POSITION

AS AT 30 JUNE 2001

QANTAS GROUP

2001 2000

Notes $M $M

CURRENT ASSETS

Cash 145.5 118.2

Receivables 1,496.2 1,742.5

Net receivables under hedge/swap contracts 241.5 200.9

Inventories 332.9 267.9

Other 142.7 108.3

Total current assets 2,358.8 2,437.8

NON-CURRENT ASSETS

Receivables 569.9 603.0

Net receivables under hedge/swap contracts 2,135.3 1,758.4

Investments 56.4 43.0

Property, plant and equipment 7,324.4 7,108.7

Intangibles 21.5 25.0

Deferred tax assets 30.9 13.3

Other 16.4 17.9

Total non-current assets 10,154.8 9,569.3

Total assets 12,513.6 12,007.1

CURRENT LIABILITIES

Accounts payable 2,049.1 1,869.2

Interest-bearing liabilities 974.7 582.4

Net payables under hedge/swap contracts 257.9 233.5

Provisions 512.8 926.7

Current tax liabilities (8.8) 119.9

Revenue received in advance 1,187.8 1,181.0

Deferred lease benefits/income 39.8 41.6

Total current liabilities 5,013.3 4,954.3

NON-CURRENT LIABILITIES

Interest-bearing liabilities 2,355.6 2,530.8

Net payables under hedge/swap contracts 576.7 419.5

Provisions 360.4 341.4

Deferred tax liabilities 496.1 405.6

Deferred lease benefits/income 381.6 439.0

Other 14.0 52.1

Total non-current liabilities 4,184.4 4,188.4

Total liabilities 9,197.7 9,142.7

Net assets 3,315.9 2,864.4

EQUITY

Contributed equity 92,173.0 1,882.0

Reserves 54.3 54.0

Retained profits 71,078.0 926.8

Equity attributable to Members of the Company 3,305.3 2,862.8

Outside equity interests in controlled entities 10.6 1.6

Total equity 3,315.9 2,864.4

The Statement of Financial Position should be read in conjunction with the Discussion and Analysis on page 37 and the Notes to the Financial

Statements on pages 40 to 45.