Public Storage 2000 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2000 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

P

UBLIC

S

TORAGE

, I

NC

. 2000 A

NNUAL

R

EPORT

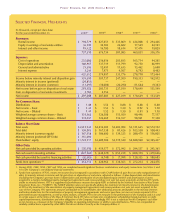

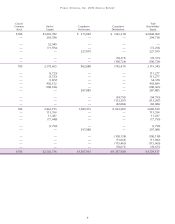

compared to 92.5 percent in 1999. Same

Store average annual realized rents were

$10.36 per square foot for 2000, compared

to $9.89 for 1999. Realized rent per occupied

square foot represents the actual revenue

earned per occupied square foot. We believe

this is a more relevant measure than posted

or scheduled rates, since posted rates can be

discounted through promotions. Same Store

rental income advanced to $547,904,000

for 2000, versus $524,880,000 for 1999.

Same Store cost of operations increased to

$164,197,000 for 2000, compared to

$154,974,000 for 1999. Net operating income

was $383,707,000 for 2000, compared to

$369,906,000 for 1999.

In December 2000, the Company

issued publicly 1,282,500 depositary shares,

each representing 1/1,000 of a share of the

Company’s Equity Stock, Series A, raising net

proceeds of $28,518,000. In January 2001,

the Company completed a public offering

of 6,900,000 depositary shares ($25 stated

value per depositary share) each representing

1/1,000 of a share of 8.6% Cumulative

Preferred Stock, Series Q, raising net

proceeds of approximately $167,066,000.

The Board of Directors has authorized

the repurchase from time to time of up

to 20,000,000 shares of the Company’s

common stock on the open market or in

privately negotiated transactions. In 2000,

the Company repurchased a total of

3,491,600 shares at an aggregate cost of

approximately $77,799,000. Cumulatively

since the repurchase announcement,

through December 31, 2000, the Company

repurchased a total of 10,900,427 shares

of common stock at an aggregate cost of

approximately $258,620,000. From January

1, 2001 through March 14, 2001, the

Company repurchased 3,961,800 shares

at an aggregate cost of approximately

$102,200,000.

Net Income

In Millions

(1) “Same Store” refers to stabilized self-storage facilities in which the Company had an interest since January 1, 1994.

(2) Assumes conversion of the Company’s Convertible Preferred Stock into common stock. Includes 7,000,000 Class B

common shares in computing weighted average common equivalent shares for all periods.

0

100

150

200

$300

50

250

1998 1999 2000

Total Revenues

In Millions

0

150

300

450

600

$750

1998 1999 2000

Weighted Average

Occupancy Levels

Same Store Facilities

(1)

84

86

88

90

92

94%

1998 1999 2000

92.5% 92.5% 92.3%

Funds From Operations

Per Common Equivalent Share

In Millions

(2)

0

1.00

1.50

2.00

2.50

$3.00

.50

1998 1999 2000

$2.50

$2.11

$2.59

Funds From Operations

Allocable to

Common Shareholders

In Millions

0

50

200

300

$350

100

150

250

1998 1999 2000

Annual Realized Rent

Per Occupied Square Foot

Same Store Facilities

(1)

0

2.00

4.00

6.00

8.00

$10.00

1998 1999 2000

$10.36

$9.89

$9.46

Shareholders’ Equity

In Billions

0

1.0

1.5

2.0

2.5

3.5

$4.0

0.5

3.0

1998 1999 2000

Total Assets

In Billions

0

1.0

2.0

$5.0

3.0

4.0

1998 1999 2000

Debt as Percent of

Shareholders’ Equity

0

1

2

3

4

5%

1998 1999 2000

2.6%

4.5%

4.2%