Public Storage 2000 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2000 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

P

UBLIC

S

TORAGE

, I

NC

. 2000 A

NNUAL

R

EPORT

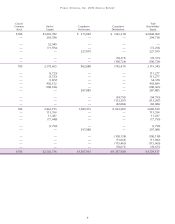

During 1998, we completed mergers with two affiliated public REITs. We acquired all the outstanding stock of the REITs for

an aggregate cost of $37,132,000, consisting of the issuance of 433,526 shares of the Company’s common stock ($13,817,000),

a $18,571,000 reduction of the Company’s pre-existing investment and $4,744,000 in cash.

Partnership acquisitions

During 2000, we acquired the remaining ownership interests in a partnership, of which we are the general partner, for an aggregate

acquisition cost of $81,169,000, consisting of cash of $66,776,000 and the reduction of our pre-existing investment in the amount of

$14,393,000. Prior to the acquisition, we accounted for our investment in the partnership using the equity method of accounting.

During 1999, we acquired all of the limited partner interests in fourteen partnerships, which owned an aggregate of 40 storage

facilities. Prior to the acquisitions, we accounted for our investment in each of these partnerships using the equity method. As a result

of increasing our ownership interest and obtaining control of the partnerships, we began to consolidate the accounts of the partner-

ships in the consolidated financial statements. The aggregate amount of the interests acquired totaled $118,453,000 consisting of a

$43,476,000 reduction of the Company’s pre-existing investment and cash of $74,977,000.

During 1998, we increased our ownership interest in three limited partnerships in which the Company is the general partner. Prior

to the acquisitions, we accounted for our investment in each of the three partnerships using the equity method. As a result, we began

to consolidate the accounts of these partnerships for financial statement purposes. The aggregate amount of the interests acquired

totaled $149,534,000 consisting of a $68,395,000 reduction of the Company’s pre-existing investment and cash of $81,139,000.

The mergers were structured as tax-free transactions. The mergers and acquisitions of affiliated limited partner interests have been

accounted for using the purchase method. Accordingly, allocations of the total acquisition cost to the net assets acquired were made

based upon the fair value of such assets and liabilities assumed with respect to the transactions occurring in 2000, 1999, and 1998 are

summarized as follows:

Partnership Storage Trust REIT

(Amounts in thousands) Acquisitions Merger Mergers Total

2000 business combinations:

Real estate facilities $ 82,163 $ — $ — $ 82,163

Other assets 183 ——183

Accrued and other liabilities (1,177) ——(1,177)

$ 81,169 $ — $ — $ 81,169

1999 business combinations:

Real estate facilities $129,348 $598,577 $ —$727,925

Construction in process —11,449 —11,449

Investment in real estate entities —356 —356

Mortgage notes receivable —6,739 —6,739

Other assets 386 2,909 —3,295

Accrued liabilities (6,089) (17,345) —(23,434)

Minority interest (5,192) (27,009) —(32,201)

$118,453 $575,676 $ —$694,129

1998 business combinations:

Real estate facilities $151,028 $ —$ 73,971 $224,999

Other assets 399 —271 670

Accrued and other liabilities (1,513) —(2,280) (3,793)

Minority interest (380) —(34,830) (35,210)

$149,534 $ —$ 37,132 $186,666