Public Storage 2000 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2000 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

P

UBLIC

S

TORAGE

, I

NC

. 2000 A

NNUAL

R

EPORT

10

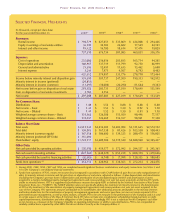

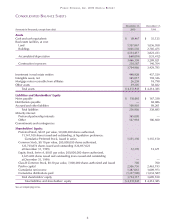

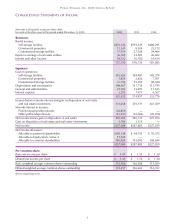

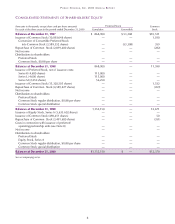

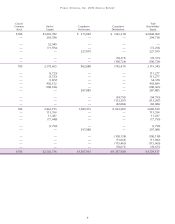

(Amounts in thousands)

For each of the three years in the period ended December 31, 2000 2000 1999 1998

Cash flows from operating activities:

Net income

$ 297,088

$ 287,885 $ 227,019

Adjustments to reconcile net income to net cash

provided by operating activities:

Less gain on disposition of real estate and real estate investments

(3,786)

(2,154) —

Depreciation and amortization

148,967

137,719 111,799

Depreciation included in equity in earnings of real estate entities

21,825

19,721 13,884

Minority interest in income

38,356

16,006 20,290

Total adjustments

205,362

171,292 145,973

Net cash provided by operating activities

502,450

459,177 372,992

Cash flows from investing activities:

Principal payments received on mortgage notes receivable

7,650

28,837 46,897

Acquisition of minority interests

(31,271)

(36,846) (22,845)

Notes receivable from affiliates

(11,400)

(30,594) (33,000)

Acquisition of real estate facilities

(62,938)

(26,640) (46,064)

Acquisition cost of business combinations

(66,776)

(180,216) (85,883)

Reduction in cash due to the deconsolidation of

PS Business Parks, Inc. (See Note 2)

—

—(11,260)

Investment in containerized storage business

—

—(2,571)

Investments in real estate entities

(75,146)

(77,656) (99,934)

Construction in process

(232,918)

(109,047) (79,132)

Capital improvements to real estate facilities

(33,023)

(29,023) (31,714)

Proceeds from the sale of real estate facilities and real estate investments

58,319

12,656 10,275

Net cash used in investing activities

(447,503)

(448,529) (355,231)

Cash flows from financing activities:

Net paydown on revolving line of credit

—

—(7,000)

Net proceeds from the issuance of preferred stock

—

276,932 —

Net proceeds from the issuance of preferred partnership units

361,250

——

Net proceeds from the issuance of Equity Stock, Series A

68,318

——

Net proceeds from the issuance of common stock

4,608

10,000 237,860

Repurchase of the Company’s common stock

(77,799)

(108,565) (72,256)

Principal payments on mortgage notes payable

(11,335)

(14,088) (15,131)

Distributions paid to shareholders

(343,388)

(208,090) (179,101)

Distributions paid to minority interests

(45,494)

(25,300) (32,312)

Investment by minority interests

17,871

61,928 54,809

Other

5,364

435 5,140

Net cash used in financing activities

(20,605)

(6,748) (7,991)

Net increase in cash and cash equivalents

34,342

3,900 9,770

Cash and cash equivalents at the beginning of the year

55,125

51,225 41,455

Cash and cash equivalents at the end of the year

$ 89,467

$ 55,125 $ 51,225

See accompanying notes.

C

ONSOLIDATED

S

TATEMENTS OF

C

ASH

F

LOWS