Public Storage 2000 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2000 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

P

UBLIC

S

TORAGE

, I

NC

. 2000 A

NNUAL

R

EPORT

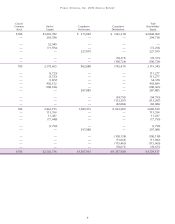

Operating facilities

During 2000, we acquired a total of 13 facilities for an aggregate cost of $82,163,000 in connection with a business combination

(Note 3). In addition, we acquired 12 storage facilities and 2 industrial facilities for an aggregate cost of $67,107,000, consisting of

$62,938,000 cash, the issuance of the Company’s Equity Stock, Series A ($1,025,000) and an existing investment ($3,144,000). In

addition, we opened 24 facilities we had developed and completed various expansions of existing storage facilities at an aggregate

cost of $135,095,000.

During 2000, we disposed of eight storage facilities to a buyer whom we had previously granted an option to purchase, and two

plots of land for an aggregate of $20,561,000, consisting of cash ($10,444,000), the acquisition of minority interest ($6,427,000),

and a note receivable ($3,690,000). An aggregate gain of $296,000 was recorded on these dispositions.

During 1999, we acquired a total of 253 real estate facilities for an aggregate cost of $727,925,000 in connection with certain

business combinations (Note 3). In addition, we also acquired three storage facilities and two industrial facilities for an aggregate cost

of $36,013,000, consisting of the cancellation of mortgage notes receivable ($5,573,000), other assets ($3,800,000), and cash

($26,640,000).

In April 1999, we sold six properties for approximately $10,500,000 (composed of $1,460,000 cash, notes receivable of $5,240,000,

and other assets of $3,800,000) and granted the buyer an option to acquire an additional eight properties.

In addition, during 1999, we disposed of an industrial facility, two storage facilities through condemnation proceedings, and four plots

of land for an aggregate of approximately $16,416,000, composed of $11,196,000 cash and $5,220,000 mortgage notes receivable. In

aggregate, we recorded a gain upon sale of $2,154,000, representing the difference between the proceeds received and the net book

value of the real estate.

During 1998, we acquired a total of 53 real estate facilities for an aggregate cost of $224,999,000 in connection with certain business

combinations (Note 3). We also acquired two storage facilities for an aggregate cost of $9,384,000, consisting of the cancellation of

mortgage notes receivable ($2,495,000), the Company’s existing investment ($527,000), and cash ($6,362,000). In addition, three

commercial facilities were acquired for an aggregate cost of $55,434,000 consisting of the assumption of mortgage notes payable

($14,526,000), the issuance of minority interests ($1,206,000) and cash ($39,702,000).

Effective April 1, 1998, we no longer included the accounts of PSB in our consolidated financial statements (Note 2). As a result

of this change, real estate facilities and accumulated depreciation were reduced by $498,691,000 and $65,245,000, respectively,

reflecting our historical cost of the PSB real estate facilities which are no longer included in the consolidated financial statements.

A substantial number of the real estate facilities acquired during 2000, 1999, and 1998 were acquired from affiliates in connection

with business combinations with an aggregate acquisition cost of approximately $82,163,000, $129,348,000, and $224,999,000

respectively.

Construction in process

Construction in process consists of land and development costs relating to the development of storage facilities. In April 1997, the

Company and an institutional investor created a joint venture for the purpose of developing up to $220 million of storage facilities. We

own 30% of the joint venture interest and the institutional investor owns the remaining 70% interest. We periodically transferred newly

developed properties, the cost of which were included in real estate, to the partnership as part of our capital contribution to the

partnership. Due to our ownership of less than 50%, our investment in the joint venture is accounted for using the equity method

(See Note 5).

In November 1999, we formed a second joint venture with a joint venture partner whose partners include an institutional investor

and B. Wayne Hughes, chairman and chief executive officer of the Company to participate in the development of approximately $100

million of storage facilities and to purchase $100 million of the Company’s Equity Stock, Series AAA. The joint venture is funded solely

with equity capital consisting of 51% from the Company and 49% from the joint venture partner. This joint venture is consolidated in

the Company’s financial statements. The term of the joint venture is 15 years. After six years the joint venture partner has the right to

cause the Company to purchase the joint venture partner’s interest for an amount necessary to provide it with a maximum return of

10.75% per year or less in certain circumstances. The joint venture partner provides Mr. Hughes with a fixed yield of approximately

8.0% per annum.