Pentax 2015 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2015 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dividend Policy

HOYA’s basic capital policy is not only to maintain a sound financial position to secure stable and sustainable

corporate growth but also maintain an optimal balance between building retained earnings for financing future

growth and returning profits to shareholders. In addition, HOYA’s management stance is to emphasize return on

capital and generate as much profit as possible through the efficient use of the capital that shareholders have

invested in the Company. However, going beyond this, HOYA practices SVA (Shareholder Value Added)

management and aims to raise return on invested capital as high above the cost of capital as possible and aim for

maximizing corporate value.

Regarding internal reserves, resources will be preferentially appropriated to investment in the Life Care business

field, which we have positioned as a growth business. These resources are being used for market share expansion,

entry into untapped markets, and developing as well as acquiring new technologies. In addition to growth of

existing businesses, HOYA will proactively pursue various possibilities, including mergers and acquisitions, to

further enrich its business portfolio and expand business operations. In the Information Technology business field,

which has been positioned as a steady earnings business, we will continue to make capital investments that

further reinforce the technological capabilities that become the source of competitiveness, and development

investments that will contribute to the development of next-generation technologies and new products.

In determining return to shareholders, HOYA’s bases for judgment are performance results and the level of retained

earnings, funding needs in the medium-to-long term, and the composition of capital from an overall perspective.

HOYA then actively distributes dividends to shareholders and conducts share buybacks.

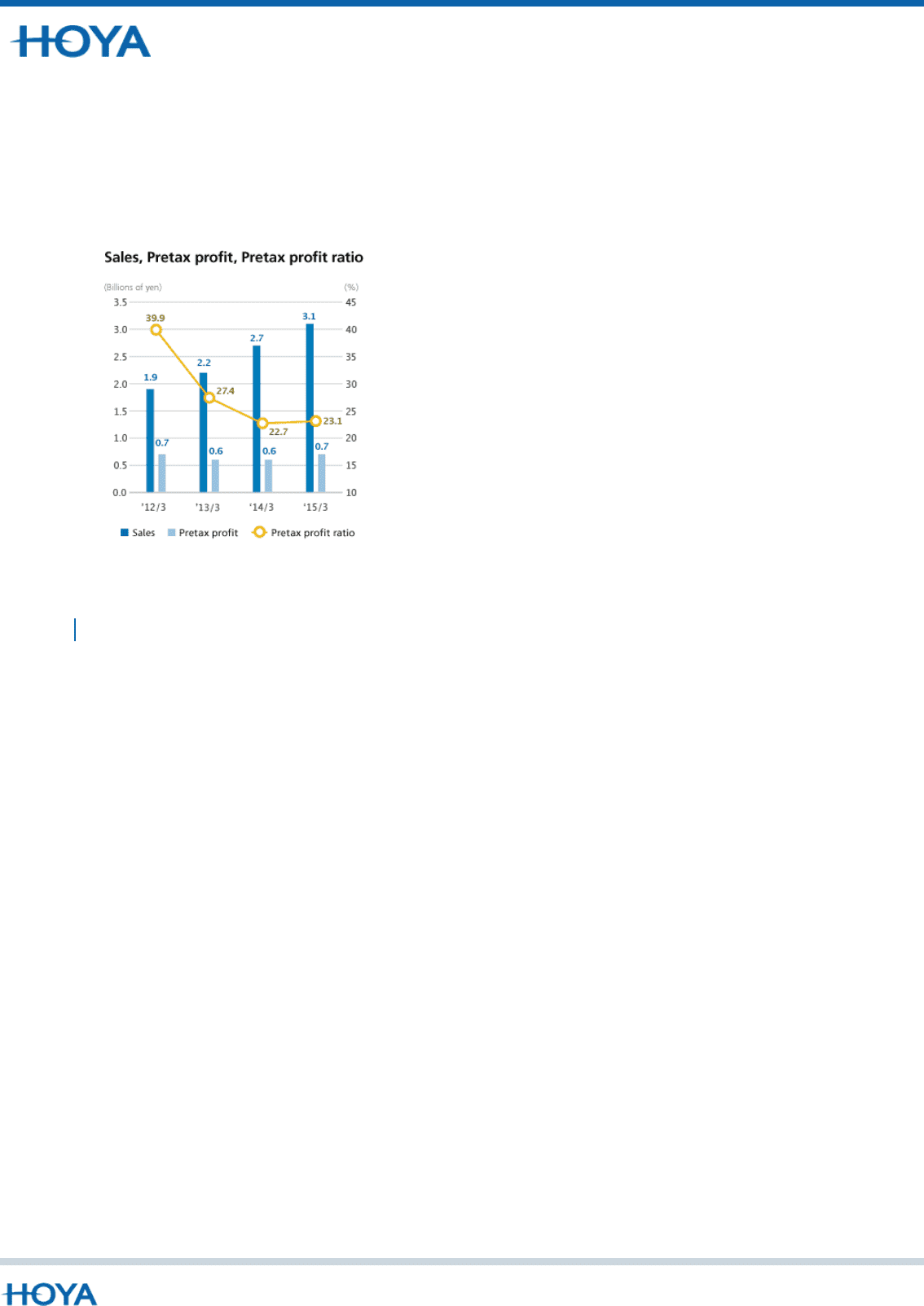

Other

The Other business segment consists mainly of information system services offered to the HOYA Group and

outside customers as well as new business development. Revenues from the segment were ¥3,117 million, 13.8%

higher than in the previous year. Segment profit amounted to ¥727 million, representing an increase of 20.8%.

Copyright ©2015 HOYA GROUP