Pentax 2015 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2015 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

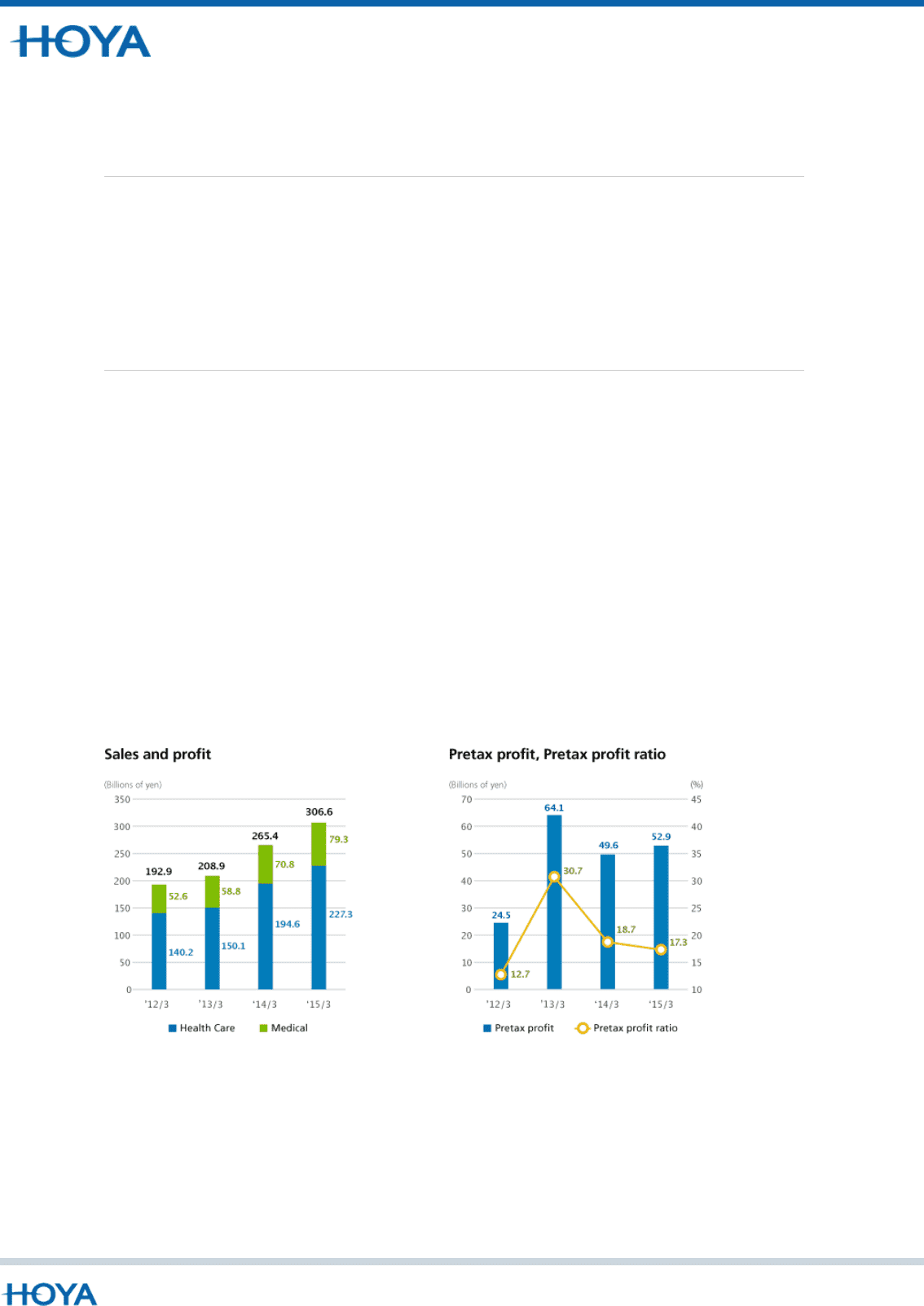

Life Care Segment

Health Care Related Products

Sales of eyeglass lenses posted a large increase from the previous consolidated fiscal year. This was due to a

number of factors, including the consolidation of the sales company for SEIKO eyeglass lenses at the end of the

previous fiscal year, an increase in sales in overseas markets and higher unit prices, and the positive effect of the

decline in the value of the yen. Sales of contact lenses decreased, despite the opening of new “Eyecity” specialty

stores and reinforced promotional campaigns at existing stores, because of the prolonged reactionary decline in

sales following the surge in demand at the end of the previous fiscal year prior to the increase in Japan’s

consumption tax on April 1.

Medical-Related Products

Sales of endoscopes decreased from the previous fiscal year. In the European region, this was because of the

reduction in government budgets in the principal countries of Europe and the deterioration of the political

conditions in certain regions (the Middle East and Russia) where sales had been strong in the previous fiscal year.

In the North American market, shipments decreased year on year because of restraints on medical expenditures,

more-intense competition, delays in introducing new products, and other factors. On the other hand, sales in the

Asia-Pacific were favorable, especially in China, Japan, and other countries of the region. Overall, even though the

decline in the value of the yen had a positive effect, sales in this business were at about the same level as in the

previous year.

In the intraocular lens (IOL) business, HOYA conducted a voluntarily recall in February 2013 for certain products,

but began to resume sales step by step in overseas markets beginning in July 2013. In the Japanese market, we

conducted an autonomous immunity survey beginning in January 2014, and then resumed full-scale marketing in

August 2014. As a result of gradual recovery in sales following the resumption of marketing, sales rose above the

previous fiscal year.

As a result, the Life Care segment reported sales of ¥306,653 million, an increase of 15.5% year on year. The

segment profit before tax was ¥52,936 million, representing an increase of 6.5% year on year.

Copyright ©2015 HOYA GROUP