Panasonic 2010 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2010 Panasonic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

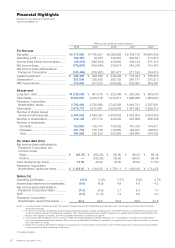

Millions of yen, except per share information

2010 2009 2008 2007 2006

For the year

Net sales ............................................. ¥7,417,980 ¥7,765,507 ¥9,068,928 ¥9,108,170 ¥8,894,329

Operating profit ................................... 190,453 72,873 519,481 459,541 414,273

Income (loss) before income taxes ....... (29,315) (382,634) 434,993 439,144 371,312

Net income (loss) ................................. (170,667) (403,843) 310,514 248,316 153,423

Net income (loss) attributable to

Panasonic Corporation ...................... (103,465) (378,961) 281,877 217,185 154,410

Capital investment* .............................. ¥ 385,489 ¥ 494,368 ¥ 449,348 ¥ 418,334 ¥ 345,819

Depreciation* ....................................... 251,839 325,835 282,102 280,177 275,213

R&D expenditures ................................ 476,903 517,913 554,538 578,087 564,781

At year-end

Long-term debt ................................... ¥1,028,928 ¥ 651,310 ¥ 232,346 ¥ 226,780 ¥ 264,070

Total assets ......................................... 8,358,057 6,403,316 7,443,614 7,896,958 7,964,640

Panasonic Corporation

shareholders’ equity ........................... 2,792,488 2,783,980 3,742,329 3,916,741 3,787,621

Total equity .......................................... 3,679,773 3,212,581 4,256,949 4,467,895 4,289,212

Number of shares issued

at year-end (thousands) ..................... 2,453,053 2,453,053 2,453,053 2,453,053 2,453,053

Number of shareholders ...................... 316,182 277,710 234,532 250,858 252,239

Number of employees:

Domestic ......................................... 152,853 132,144 135,563 145,418 144,871

Overseas ......................................... 231,733 160,106 170,265 183,227 189,531

Total ................................................. 384,586 292,250 305,828 328,645 334,402

Per share data (Yen)

Net income (loss) attributable to

Panasonic Corporation per

common share

Basic ............................................... ¥ (49.97) ¥ (182.25) ¥ 132.90 ¥ 99.50 ¥ 69.48

Diluted ............................................. —(182.25) 132.90 99.50 69.48

Cash dividends per share .................... 12.50 40.00 32.50 25.00 17.50

Panasonic Corporation

shareholders’ equity per share ........... ¥ 1,348.63 ¥ 1,344.50 ¥ 1,781.11 ¥ 1,824.89 ¥ 1,714.22

Ratios (%)

Operating profit/sales .......................... 2.6% 0.9 % 5.7% 5.0% 4.7%

Income (loss) before income taxes/sales.. (0.4) (4.9) 4.8 4.8 4.2

Net income (loss) attributable to

Panasonic Corporation/sales ............. (1.4) (4.9) 3.1 2.4 1.7

ROE .................................................... (3.7) (11.8) 7.4 5.6 4.2

Panasonic Corporation

shareholders’ equity/total assets ........ 33.4 43.5 50.3 49.6 47.6

Notes: 1. In computing cash dividends per share, the number of shares at the end of the applicable period has been used. Cash dividends per share reflect those paid

during each fiscal year.

2. In order to be consistent with generally accepted financial reporting practices in Japan, operating profit, a non-GAAP measure, is presented as net sales less cost

of sales and selling, general and administrative expenses. The Company believes that this is useful to investors in comparing the Company’s financial results with

those of other Japanese companies. See the consolidated statements of operations on page 64.

3. In accordance with the adoption of the provisions of FASB Accounting Standards Codification (ASC) No. 810, “Consolidation,” information for fiscal 2009 and

prior years has been reclassified and restated. (“Net income (loss) attributable to Panasonic Corporation” is computed the same as “Net income (loss)” up until the

year ended March 31, 2009.)

4. Diluted net income (loss) attributable to Panasonic Corporation per common share for fiscal 2010 has been omitted because the Company did not have potential

common shares that were outstanding for the period.

* Excluding intangibles

2Panasonic Corporation 2010

Financial Highlights

Panasonic Corporation and Subsidiaries

Years ended March 31