PNC Bank 2003 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2003 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

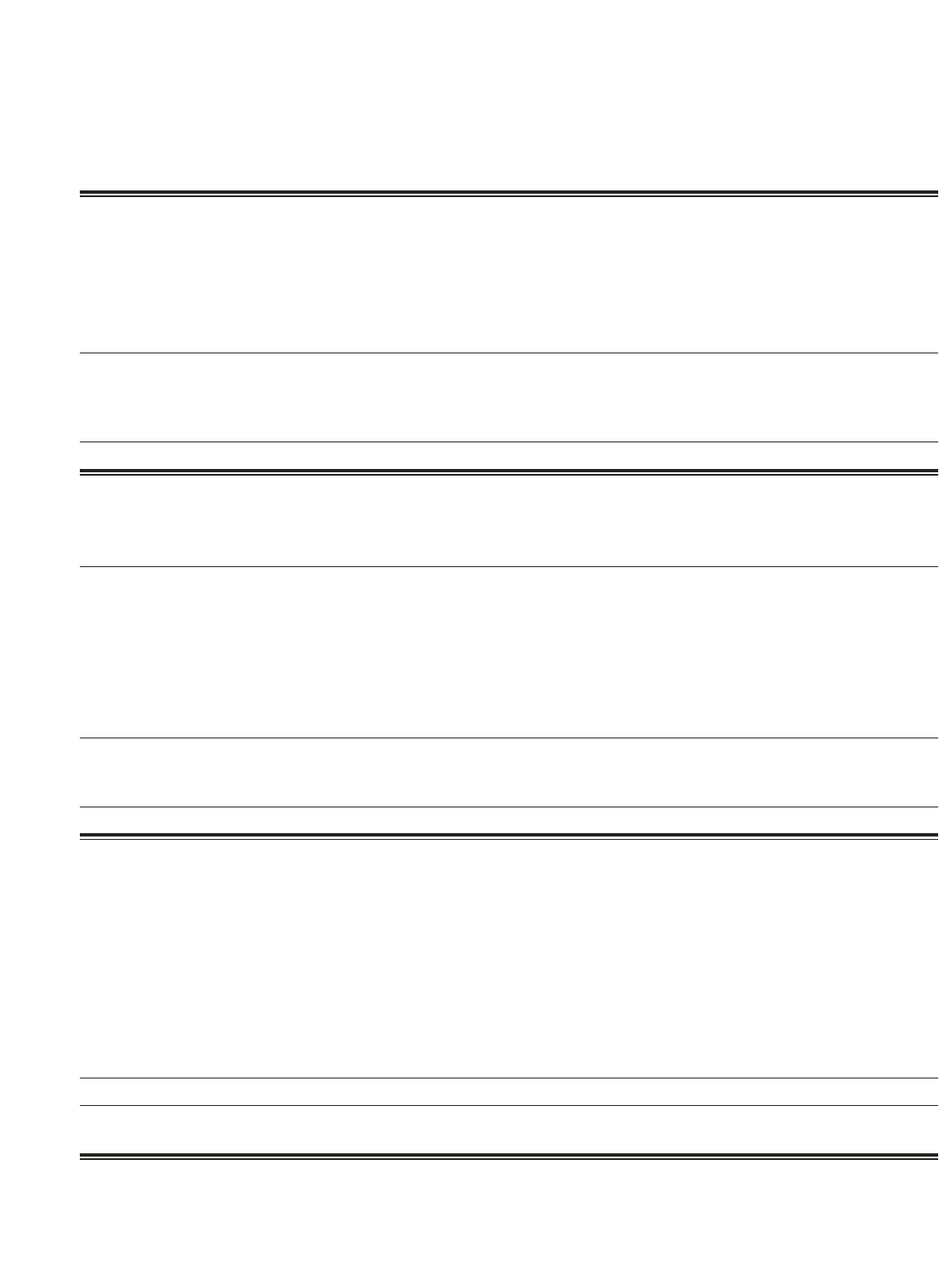

December 31

In millions, except par value 2003 2002

Assets

Cash and due from banks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,968 $ 3,201

Federal funds sold and other short-term investments . . . . . . . . . . . . . 2,596 3,658

Loans held for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,400 1,607

Securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,690 13,763

Loans, net of unearned income of $1,009 and $1,075 . . . . . . . . . . . . . . 34,080 35,450

Allowance for credit losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (632) (673)

Net loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33,448 34,777

Goodwill and other intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . 2,707 2,646

Purchased customer receivables(a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,223

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,136 6,725

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $68,168 $66,377

Liabilities

Deposits

Noninterest-bearing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $11,505 $10,563

Interest-bearing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33,736 34,419

Total deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45,241 44,982

Borrowed funds

Federal funds purchased and repurchase agreements . . . . . . . . . . . . 1,250 852

Bank notes and senior debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,823 4,400

Federal Home Loan Bank borrowings . . . . . . . . . . . . . . . . . . . . . . . . 1,115 1,256

Subordinated debt(b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,729 2,423

Commercial paper(a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,226

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 310 185

Total borrowed funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,453 9,116

Allowance for unfunded loan commitments and letters of credit . . . . . 90 84

Accrued expenses and other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,277 4,218

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61,061 58,400

Minority and noncontrolling interests in consolidated entities . . . . . . 462 270

Mandatorily redeemable capital securities of subsidiary trusts(b) . . . . . 848

Shareholders’ Equity

Common stock—$5 par value

Authorized 800 shares, issued 353 shares . . . . . . . . . . . . . . . . . . . . . 1,764 1,764

Capital surplus . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,108 1,101

Retained earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,642 7,187

Deferred benefit expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (29) (9)

Accumulated other comprehensive income . . . . . . . . . . . . . . . . . . . . . 60 321

Common stock held in treasury at cost: 76 and 68 shares . . . . . . . . . . (3,900) (3,505)

Total shareholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,645 6,859

Total liabilities, minority and noncontrolling interests, capital

securities and shareholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . $68,168 $66,377

(a) Amounts at December 31, 2003 reflect PNC’s adoption of FASB Interpretation No. 46 (Revised 2003), “Consolidation of Variable Interest Entities” (FIN 46R).

(b) Effective December 31, 2003, PNC deconsolidated the assets and liabilities of PNC Institutional Trust A, Trust B, Trust C and Trust D (the Trusts) based upon guidance

included in FIN 46R. The deconsolidation of these Trusts removed $1.148 billion of mandatorily redeemable capital securities of subsidiary trusts issued by these Trusts

while adding$1.184 billion of junior subordinated debentures and $36 million of other assets to the Consolidated Balance Sheet at December 31, 2003.

Condensed Consolidated Balance Sheet

The PNC Financial Services Group, Inc.