PACCAR 2009 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2009 PACCAR annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

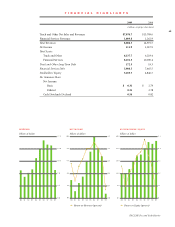

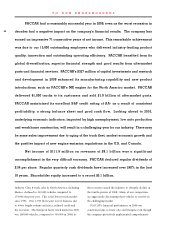

cost reductions. After-tax return on beginning

shareholder equity (ROE) was 2.3% in 2009, compared

to 20.3% in 2008. The company’s 2009 after-tax return

on revenues was 1.4%. PACCAR’s long-term financial

performance, even in a turbulent, cyclical market, has

enabled the company to distribute over $3.6 billion

in dividends during the last 10 years and increase

shareholder equity to $5.1 billion. PACCAR’s average

annual total shareholder return was 19.1% over the last

decade, versus a negative 1.0% for the Standard & Poor’s

500 Index. The fragility of global financial institutions

provided a timely reminder of the merits and strength

of PACCAR’s conservative business approach, quality

products and customer service focus.

INVESTING FOR THE FUTURE — PACCAR’s excellent

long-term profits, strong balance sheet, and intense focus

on quality, technology and productivity enhancements

have allowed the company to invest $3.8 billion since

2000 in capital projects, new products and processes.

Productivity and efficiency improvement of 5-7%

annually and capacity improvements of over 100% in

the last five years have enhanced the capability of the

company’s manufacturing and parts facilities. PACCAR

is recognized as one of the leading applied technology

companies in the industry, and innovation continues to

be a cornerstone of its success. PACCAR has integrated

new technology to profitably support its business, as

well as its dealers, customers and suppliers.

Capital investments were $128 million in 2009.

One exciting multi-year initiative was completion of

construction of PACCAR’s engine plant in Mississippi.

The installation of the machining and assembly lines is

underway. Other major capital projects during the year

included investments to meet the exacting 2010 EPA

engine emission regulations, expansion of PACCAR

Australia’s manufacturing and parts distribution capacity,

and installation of Technology Centers in our assembly

facilities.

PACCAR continues to examine business opportunities

in Asia, with its primary focus on China and India.

PACCAR is increasing its component purchases and

powertrain sales in China as a result of its Shanghai and

Beijing offices. The PACCAR MX engine has been

honored as best-in-class at the Shanghai Bus Show three

years in a row.

SIX SIGMA — Six Sigma is integrated into all business

activities at PACCAR and has been adopted at 190 of

the company’s suppliers and many of the company’s

dealers and customers. Its statistical methodology is

critical in the development of new product designs,

customer services and manufacturing processes. Since

inception, Six Sigma has delivered over $1.4 billion in

cumulative savings in all facets of the company. Over

10,000 employees have been trained in Six Sigma and

12,000 projects have been implemented since its

inception. Six Sigma, in conjunction with Supplier

Quality, has been vital to improving logistics performance

and component quality from company suppliers.

INFORMATION TECHNOLOGY — PACCAR’s

Information Technology Division (ITD) and its 639

innovative employees are an important competitive

asset for the company. PACCAR’s use of information

technology is centered on developing and integrating

software and hardware that enhance the quality and

efficiency of all products and operations throughout the

company. In 2009, ITD provided innovative advancements

in new engine manufacturing software and infrastructure

capacity upgrades. Over 20,000 dealers, customers,

suppliers and employees have experienced the company’s

Technology Centers highlighting surface computing,

tablet PCs, an electronic leasing and finance office, and

an electronic service analyst.

TRUCKS — U.S. and Canadian Class 8 industry retail

sales in 2009 were 108,000 units, and the Mexican market

totaled 11,000. The European Union (EU) industry

heavy truck sales were 168,000 units.

PACCAR’s Class 8 retail sales in the U.S. and Canada

achieved a market share of 25.1% in 2009 compared to

26.0% the prior year. DAF achieved a record 14.8%

share in the 15+ tonne truck market in Europe. Industry

Class 6 and 7 truck retail sales in the U.S. and Canada

were 40,000 units, a 36% decrease from the previous

year. In the EU, the 6- to 15-tonne market was 51,000

units, down 36% from 2008. PACCAR’s North American

and European market shares in the medium duty truck

segment were very good, as the company delivered

12,900 medium duty trucks and tractors in 2009.

A tremendous team effort by the company’s

purchasing, materials, engineering and production

employees contributed to improved product quality and