PACCAR 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 PACCAR annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TO OUR SHAREHOLDERS

PACCAR had a reasonably successful year in 2009, even as the worst recession in

decades had a negative impact on the company’s financial results. The company has

earned an impressive 71 consecutive years of net income. This remarkable achievement

was due to our 15,000 outstanding employees who delivered industry-leading product

quality, innovation and outstanding operating efficiency. PACCAR benefited from its

global diversification, superior financial strength and good results from aftermarket

parts and financial services. PACCAR’s $327 million of capital investments and research

and development in 2009 enhanced its manufacturing capability and new product

introductions, such as PACCAR’s MX engine for the North America market. PACCAR

delivered 61,000 trucks to its customers and sold $1.9 billion of aftermarket parts.

PACCAR maintained its excellent S&P credit rating of AA- as a result of consistent

profitability, a strong balance sheet and good cash flow. Looking ahead to 2010,

underlying economic indicators, impacted by high unemployment, low auto production

and weak home construction, will result in a challenging year for our industry. There may

be some sales improvement due to aging of the truck fleet, modest economic growth and

the positive impact of new engine emission regulations in the U.S. and Canada.

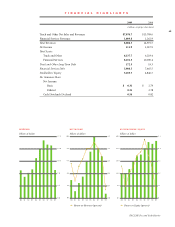

Net income of $111.9 million on revenues of $8.1 billion was a significant

accomplishment in the very difficult economy. PACCAR declared regular dividends of

$.54 per share. Regular quarterly cash dividends have increased over 240% in the last

10 years. Shareholder equity increased to a record $5.1 billion.

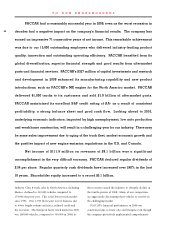

Industry Class 8 truck sales in North America, including

Mexico, declined to 119,000 vehicles compared to

179,000 the prior year. This is the lowest truck market

since 1991. Over 1,700 fleets went out of business due

to lower freight volume and rates, reduced credit and

the recession. The European heavy truck market in 2009

was 168,000 vehicles, compared to 330,000 in 2008, as

the recession caused the industry to abruptly decline in

the fourth quarter of 2008. Many of our competitors

are aggressively discounting their vehicles to survive in

the challenging market.

PACCAR’s financial performance in 2009 was

constrained due to lower sales and margins even though

the company proactively implemented comprehensive