Office Depot 2007 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

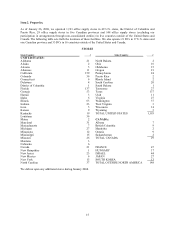

5

Distribution Centers

Open at

Beginning

of Period

Opened/

Acquired Closed

Open at

End

of Period

2005......................................................................... 25 3

(2) 3 25

2006......................................................................... 25 10

(3) 3 32

2007......................................................................... 32 2 1 33

____________

(1) Includes 33 retail stores obtained in the acquisition of the business in Israel and nine retail stores obtained in the

acquisition of the business in South Korea.

(2) Includes two DCs that were previously excluded as planned post-integration closures.

(3) Includes one DC obtained in the acquisition of the business in Israel, five DCs obtained in the acquisition of the

business in China, one DC obtained in the acquisition of the business in South Korea and two DCs obtained in

the acquisition of Papirius that are located in the Czech Republic and Lithuania (Lithuania is being considered

for disposition).

Merchandising

Our merchandising strategy is to meet our existing and target customers’ needs by offering a broad selection of

branded office products, as well as an increasing array of private brand products and services. Our selection of

private brand products has increased in breadth and level of sophistication over time. We currently offer general

office supplies, computer supplies, business machines and related supplies, and office furniture under various labels,

including Office Depot®, Viking Office Products®, Niceday™, Foray®, Ativa®, Break Escapes™, Worklife™ and

Christopher Lowell™.

Total sales by product group were as follows:

2007 2006 2005

Supplies............................................................................................... 63.2% 60.8% 61.3%

Technology.......................................................................................... 26.0% 26.1% 25.6%

Furniture and other.............................................................................. 10.8% 13.1% 13.1%

100.0% 100.0% 100.0%

We buy substantially all of our merchandise directly from manufacturers and other primary suppliers, including

direct sourcing of products from domestic and offshore sources. We also enter into arrangements with vendors that

can lower our unit product costs if certain volume thresholds or other criteria are met. For additional discussion

regarding these arrangements, see the Critical Accounting Policies section of MD&A. In most cases, our suppliers

deliver merchandise directly to our DCs or crossdocks. The latter are flow-through facilities that re-supply our retail

stores in North America at low handling and freight costs.

We operate separate merchandising functions in North America, Europe and Asia as well as in our joint ventures.

Each group is responsible for selecting, purchasing and pricing merchandise as well as managing the product life

cycle of our inventory. In recent years, we have increasingly used global tenders across all regions to further reduce

our product cost while maintaining product quality.

During 2007, we opened a global sourcing office in Shenzhen, China, which allows us to take more direct control of

our product sourcing, logistics and quality assurance. This new office consolidates our purchasing power with Asian

factories and, in turn, helps us to increase the scope of our private brand offerings. Also, because of the proximity to

vendors, manufacturers, logistics partners and seaports, we can source products globally in a cost-effective manner.