Office Depot 2007 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13

Regulatory Environment: While all businesses are subject to regulatory matters relating to the conduct of their

businesses, including consumer protection laws, advertising regulations, wage and hour regulations and the like,

certain jurisdictions have taken a particularly aggressive stance with respect to such matters and have stepped up

enforcement, including fines and other sanctions. We transact substantial amounts of business in certain such

jurisdictions, and to the extent that our business locations are exposed to what might be termed an overly aggressive

enforcement environment or legal or regulatory systems that authorize or encourage private parties to pursue relief

under so-called private attorney general laws and similar authorizations for private parties to pursue enforcement of

governmental laws and regulations, the resulting fines and exposure to third party liability (such as monetary

recoveries and recoveries of attorneys fees) could have a material adverse effect on our business and results of

operations, including the added cost of increased preventative measures that we may determine to be necessary to

conduct business in such locales.

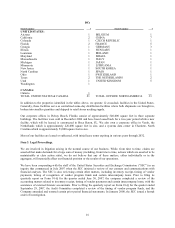

Litigation Risks: Litigation and governmental investigations or proceedings arising out of or related to our Audit

Committee’s internal accounting review could result in substantial costs. The SEC has issued a formal order of

investigation to determine whether we have violated the Federal securities laws. Although we are cooperating with

the SEC in this matter, the SEC may determine that we have violated Federal securities laws. We cannot predict

when this investigation will be completed or its outcome. If the SEC makes a determination that we have violated

Federal securities laws, we may face sanctions, including, but not limited to, significant monetary penalties and

injunctive relief.

In addition, we have been named a defendant in a number of class-action and related lawsuits. The findings and

outcome of the SEC investigation may affect the class-action and derivative lawsuits that are pending. We are

generally obliged, to the extent permitted by law, to indemnify our directors and our former directors and officers

who are named defendants in some of these lawsuits. We are unable to estimate what our liability in these matters

may be, and we may be required to pay judgments or settlements and incur expenses in aggregate amounts that

could have a material adverse effect on our financial condition or results of operations. See “Part II — Item 1 —

Legal Proceedings” for a description of pending litigation and governmental proceedings and investigations.

Regulatory Risks: We are subject to a formal order of investigation from the SEC, in connection with our contacts

and communications with financial analysts during 2007, as well as certain other matters, including inventory

receipt, timing of vendor payments, certain intercompany loans and the timing of recognition of vendor program

funds. We are cooperating with the SEC on all matters. A negative outcome from this investigation could require us

to restate prior financial results and could result in fines, penalties, or other remedies being imposed on us, which

under certain circumstances could have a material adverse effect on our business.

Material Weakness in Internal Controls: In connection with the restatement of our previously issued financial

statements and the related reassessment of our internal control over financial reporting pursuant to the rules

promulgated by the Commission under Section 404 of the Sarbanes-Oxley Act of 2002 and Item 308 of Regulation

S-K, management concluded that as of December 30, 2006, our disclosure controls and procedures were not

effective and that we had a material weakness in our internal control over financial reporting. Please refer to Item

9A of this Form 10-K for further discussion of the remediation of this material weakness as of December 29, 2007.

Should we identify any other material weakness, such weakness could have a material adverse effect on our

business, results of operations and financial condition, as well as impair our ability to meet our quarterly, annual and

other reporting requirements under the Securities Exchange Act of 1934 in a timely manner. These effects could in

turn adversely affect the trading price of our common stock and could result in a material misstatement of our

financial position or results of operations and require a further restatement of our financial statements.

Sales may be Negatively Impacted by Changes in the Economy that Impact Small Business and Consumer

Spending: Sales may be negatively impacted by changes in economic conditions. Our customers in the North

American Retail Division and many of our customers in the North American Business Solutions Division are

predominantly small and home office businesses. Accordingly, these customers may curtail their spending in

reaction to macroeconomic conditions, such as changes in the housing market, higher fuel costs, higher credit costs,

credit availability, possible recession and other factors. This could result in reductions in their spending on office

supplies and negatively impact our sales and profits. Further, our North American sales are heavily concentrated in

California and Florida; two states that have experienced strong economic growth in the past, but which are currently

experiencing a greater economic downturn. Because of this geographic concentration, we may have a