Office Depot 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

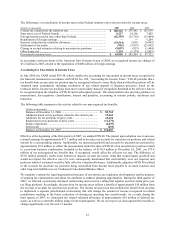

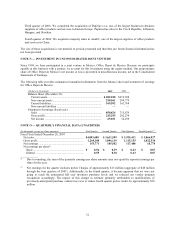

We file a U.S. federal income tax return and other income tax returns in various states and foreign jurisdictions.

With few exceptions, we are no longer subject to U.S. federal, state and local, or non-U.S. income tax examinations

for years before 2000. Our U.S. federal filings for the years 2000 and 2002 through 2006 are under routine

examination, and it is not anticipated that these audits will be closed prior to the end of 2008. Additionally, the U.S.

federal tax return for 2007 is under concurrent year review. Significant international tax jurisdictions include the

UK, the Netherlands, France and Germany. Generally, we are subject to routine examination for years 2000 and

forward in these jurisdictions.

We recognize interest related to unrecognized tax benefits in interest expense and penalties in the provision for income

taxes. We recognized interest and penalties of approximately $8 million and $5 million in 2007 and 2006, respectively.

We had approximately $35.9 million accrued for the payment of interest and penalties as of December 29, 2007.

We regularly assess our position with regard to individual non-income tax exposures and record liabilities for our

uncertain tax positions and related interest and penalties according to the principles of FAS 5, Accounting for

Contingencies. These accruals, which relate primarily to indirect taxes, reflect management’s view of the likely

outcomes of current and future audits. It is likely that the future resolution of these uncertain tax positions will be

different from the amounts currently accrued and will impact future tax period expense. However, management

believes those amounts will not be material to financial position, results of operations or cash flows.

In connection with the adoption of FAS 123R, we have elected to calculate our pool of excess tax benefits under the

alternative, or “short-cut” method. At adoption, this pool of benefits was approximately $55.3 million and was

approximately $111.2 million as of December 29, 2007. This pool may increase in future periods if tax benefits

realized are in excess of those based on grant date fair values of share-based payments and is available to absorb

future tax deficiencies determined for financial reporting purposes under provisions of FAS 123R.

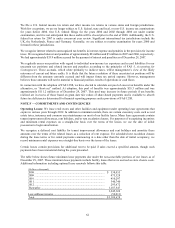

NOTE F — COMMITMENTS AND CONTINGENCIES

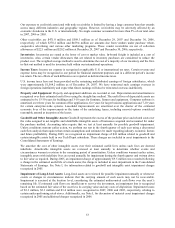

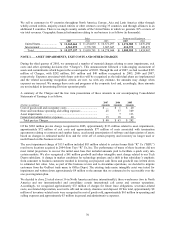

Operating Leases: We lease retail stores and other facilities and equipment under operating lease agreements that

expire in various years through 2032. In addition to minimum rentals, there are certain executory costs such as real

estate taxes, insurance and common area maintenance on most of our facility leases. Many lease agreements contain

tenant improvement allowances, rent holidays, and/or rent escalation clauses. For purposes of recognizing incentives

and minimum rental expenses on a straight-line basis over the terms of the leases, we use the date of initial

possession to begin amortization.

We recognize a deferred rent liability for tenant improvement allowances and rent holidays and amortize these

amounts over the terms of the related leases as a reduction of rent expense. For scheduled rent escalation clauses

during the lease terms or for rental payments commencing at a date other than the date of initial occupancy, we

record minimum rental expenses on a straight-line basis over the terms of the leases.

Certain leases contain provisions for additional rent to be paid if sales exceed a specified amount, though such

payments have been immaterial during the years presented.

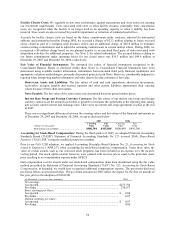

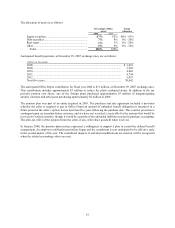

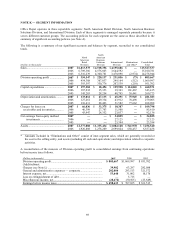

The table below shows future minimum lease payments due under the non-cancelable portions of our leases as of

December 29, 2007. These minimum lease payments include facility leases that were accrued as store closure costs.

Additional information including optional lease renewals follows this table.

(Dollars in thousands)

2008 ................................................................................................. $ 538,055

2009 ................................................................................................. 475,328

2010 ................................................................................................. 410,297

2011 ................................................................................................. 340,740

2012 ................................................................................................. 293,672

Thereafter......................................................................................... 1,187,547

3,245,639

Less sublease income ....................................................................... (56,011)

Total ................................................................................................. $ 3,189,628