Office Depot 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

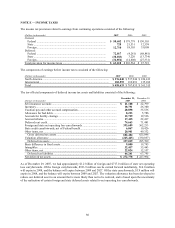

NOTE E — INCOME TAXES

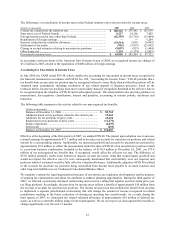

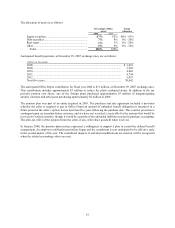

The income tax provision related to earnings from continuing operations consisted of the following:

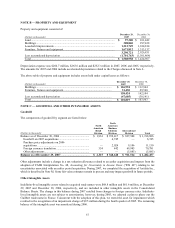

(Dollars in thousands) 2007 2006 2005

Current:

Federal ................................................................................................ $ 50,602 $ 179,779 $ 150,303

State .................................................................................................... 728 21,531 12,358

Foreign ................................................................................................ 12,710 18,103 35,008

Deferred:

Federal ................................................................................................ 72,017 (4,261) (68,881)

State .................................................................................................... (38,183) 3,220 (13,734)

Foreign ................................................................................................ (34,856) (14,808) (27,331)

Total provision for income taxes ............................................................ $ 63,018 $ 203,564 $ 87,723

The components of earnings before income taxes consisted of the following:

(Dollars in thousands) 2007 2006 2005

North America ............................................................................................ $ 276,040 $ 537,944 $ 226,413

International................................................................................................ 182,593 169,091 135,102

Total............................................................................................................ $ 458,633 $ 707,035 $ 361,515

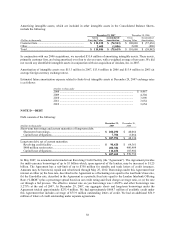

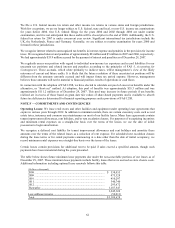

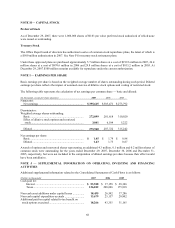

The tax-effected components of deferred income tax assets and liabilities consisted of the following:

(Dollars in thousands)

December 29,

2007

December 30,

2006

Self-insurance accruals .......................................................................................... $ 21,188 $ 22,799

Inventory................................................................................................................ 18,791 26,300

Vacation pay and other accrued compensation...................................................... 28,898 35,536

Allowance for bad debts ........................................................................................ 8,223 5,786

Accruals for facility closings ................................................................................. 12,729 19,536

Accrued rebates...................................................................................................... 17,415 22,417

Deferred rent credit................................................................................................ 74,663 71,481

Foreign and state net operating loss carryforwards................................................ 393,609 362,233

State credit carryforwards, net of Federal benefit.................................................. 6,067 10,426

Other items, net...................................................................................................... 20,901 49,332

Gross deferred tax assets.................................................................................... 602,484 625,846

Valuation allowance .............................................................................................. (265,465) (330,057)

Deferred tax assets ............................................................................................. 337,019 295,789

Basis difference in fixed assets .............................................................................. 9,000 19,795

Intangibles.............................................................................................................. 32,417 35,443

Other items, net...................................................................................................... 22,824 12,557

Deferred tax liabilities........................................................................................ 64,241 67,795

Net deferred tax assets ........................................................................................... $ 272,778 $ 227,994

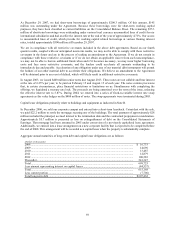

As of December 29, 2007, we had approximately $1.2 billion of foreign and $717.0 million of state net operating

loss carryforwards. Of the foreign carryforwards, $933.9 million can be carried forward indefinitely, $16.0 million

will expire in 2008, and the balance will expire between 2009 and 2027. Of the state carryforwards, $1.9 million will

expire in 2008, and the balance will expire between 2009 and 2027. The valuation allowance has been developed to

reduce our deferred asset to an amount that is more likely than not to be realized, and is based upon the uncertainty

of the realization of certain foreign and state deferred assets related to net operating loss carryforwards.