Office Depot 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

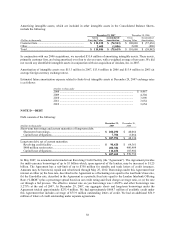

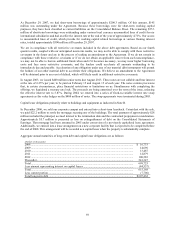

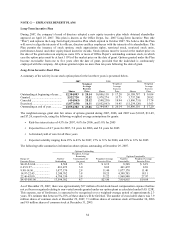

Amortizing intangible assets, which are included in other intangible assets in the Consolidated Balance Sheets,

include the following:

December 29, 2007 December 30, 2006

(Dollars in thousands)

Gross

Carrying Value

Accumulated

Amortization

Gross

Carrying Value

Accumulated

Amortization

Customer lists ................................................................ $ 112,238 $ (74,563) $ 108,086 $ (57,636)

Other.............................................................................. 2,608 (1,056) 2,600 (406)

Total............................................................................... $ 114,846 $ (75,619) $ 110,686 $ (58,042)

In conjunction with our 2006 acquisitions, we recorded $31.4 million of amortizing intangible assets. These assets,

primarily customer lists, are being amortized over four to eleven years, with a weighted average of ten years. We did

not record any identifiable intangible assets in conjunction with our acquisition of Axidata, Inc. in 2007.

Amortization of intangible assets was $15.3 million in 2007, $13.6 million in 2006 and $13.4 million in 2005 (at

average foreign currency exchange rates).

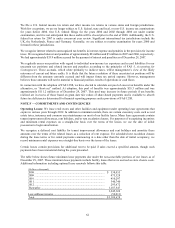

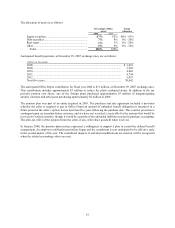

Estimated future amortization expense related to finite-lived intangible assets at December 29, 2007 exchange rates

is as follows:

(Dollars in thousands)

2008 ...................................................................................................... $ 8,467

2009 ...................................................................................................... 4,304

2010 ...................................................................................................... 3,898

2011 ...................................................................................................... 3,654

2012 ...................................................................................................... 3,654

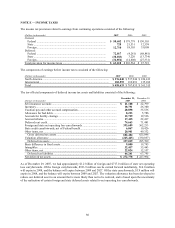

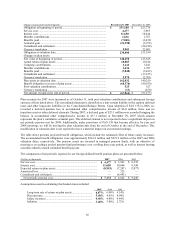

NOTE D —DEBT

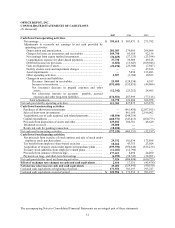

Debt consists of the following:

(Dollars in thousands)

December 29,

2007

December 30,

2006

Short-term borrowings and current maturities of long-term debt:

Short-term borrowings...................................................................... $ 200,290 $ 40,066

Capital lease obligations ................................................................... 7,706 8,064

$ 207,996 $ 48,130

Long-term debt, net of current maturities:

Revolving credit facility ................................................................... $ 90,420 $ 64,361

$400 million senior notes.................................................................. 400,384 400,489

Capital lease obligations ................................................................... 116,658 105,902

$ 607,462 $ 570,752

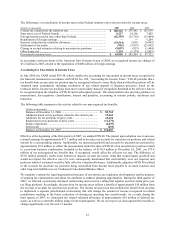

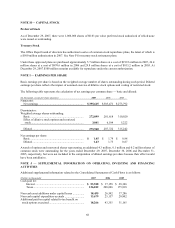

In May 2007, we amended and extended our Revolving Credit Facility (the “Agreement”). The Agreement provides

for multi-currency borrowings of up to $1 billion which, upon approval of the lenders, may be increased to $1.25

billion. The Agreement has a sub-limit of up to $350 million for standby and trade letters of credit issuances.

Amounts may be borrowed, repaid and reborrowed through May 25, 2012. Borrowings under this Agreement bear

interest at either (a) the base rate, described in the Agreement as a fluctuating rate equal to the lead bank’s base rate,

(b) the Eurodollar rate, described in the Agreement as a periodic fixed rate equal to the London Interbank Offering

Rate (“LIBOR”) plus a percentage spread based on our credit rating and fixed charge coverage ratio, or (c) the rate

set through a bid process. The effective interest rate on yen borrowings was 1.4625% and other borrowings was

5.275% at the end of 2007. At December 29, 2007, our aggregate short- and long-term borrowings under the

Agreement totaled approximately $235.4 million. We had approximately $688.7 million of available credit under

this Agreement that includes coverage of $75.9 million outstanding letters of credit. We had an additional $56.9

million of letters of credit outstanding under separate agreements.