O'Reilly Auto Parts 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 O'Reilly Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We remain dedicated to

generating profitable growth

and attractive returns.

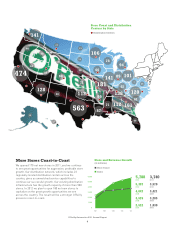

goals, are located in attractive

markets and can be staffed with

experienced and quality Team

Members. Our new store site

selection process involves an

extensive analysis of market

demographics, vehicle registration

information, the competitive environ-

ment and a comprehensive list of

other factors, all of which must be

met before the decision is made to

open a new store. Most importantly,

we conduct an exhaustive training

process to ensure that each new

store’s team of professional parts

people can deliver our high standards

of customer service and expense

control from day one. The ability to

grow over a large distribution

footprint – we have capacity for over

500 additional stores spread out

between 23 regional distribution

centers covering 39 states – is a key

factor in our efforts to develop

exceptional new store teams. As a

result, 2012 will see new O’Reilly

stores from coast to coast, including

expansion markets along the East

Coast, south into Central Florida,

and through the Ohio Valley into

Pennsylvania, with additional growth

across the country in existing markets.

New store growth has historically

proven to be an excellent return on

our shareholders’ investment and

we will continue to prudently, but

aggressively, expand our store base.

Integration of Acquired

Parts Stores

2011 marked the three year anniversary

of the acquisition of CSK and also

marked the completion of the

physical conversion and integration

of these acquired stores. We com-

pleted the final store interior resets

and replaced the remaining legacy

CSK signs during the year. Now that

the physical conversion is complete

and the acquired stores have all of

the tools necessary to execute our

Dual Market Strategy, we’ve focused

on building the strongest store teams

in the industry, which will enable

us to significantly grow our market

share in the Western States.

Although we have made significant

improvements in the top line perfor-

mance of the acquired CSK stores,

we believe we have the opportunity to

greatly improve the average revenue

per store as we continue to penetrate

the professional service provider

market. In addition, we see an

opportunity to regain retail hard part

DIY market share CSK lost in the

years prior to the acquisition. Our

ultimate goal for these stores is to

better leverage our fixed costs by

gaining as much market share as

possible, on both sides of the business,

through the execution of the proven

strategy that has made O’Reilly

successful for over 50 years.

Historically, major acquisitions

such as CSK have been a very

accretive avenue for profitable growth.

The overall automotive aftermarket

remains very fragmented, with the

top 10 chains in the U.S. accounting

for only about 45% of the total

market. The number of auto parts

retail locations nationwide has

remained around 36,000 for the last

10 years, even with the growth of the

top players in the industry. We

constantly monitor the competitive

environment and evaluate opportunities

to consolidate the industry through

acquisitions. We remain one of the

few companies in the aftermarket

willing to supplement greenfield

growth with acquisitions of single

stores or small chains. We also seek

out opportunities for larger, “tuck-in”

type acquisitions which, although no

longer available to the scale of CSK,

would allow us to enter new markets

with a significant number of stores.

For acquisitions of any size, we will

The Right Product Mix

Our stores offer a wide selection of brand-name and private-label

products for domestic and imported automobiles, vans, and trucks

tailored for each store based on the local vehicle population. All of

these parts meet or exceed original equipment requirements and

provide a superior combination of quality and value.

O’Reilly Automotive 2011 Annual Report

7