O'Reilly Auto Parts 2011 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2011 O'Reilly Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

continue to be disciplined in our

analysis and will remain a very

opportunistic buyer.

Free Cash Flow and

Share Repurchases

2011 was a transformational year for

our company in the area of capital

structure and deployment. In

January, we enacted our new

financing plans which included the

replacement of our asset based

revolver with an unsecured revolving

credit facility, the issuance of $500

million of unsecured 10 year senior

notes which carried an inaugural

investment grade credit rating, the

announcement of our targeted

leverage ratio of 2.00 to 2.25 times

adjusted debt to adjusted EBITDAR,

and the initiation of our Board

approved share repurchase program.

With the retirement of the secured

asset based facility, and fueled by our

investment grade credit ratings, we

were able to work with our banking

partners to reestablish a competitive

supplier financing program which

offers very attractive rates to

participants. Throughout 2011, we

were able to enroll many of our

suppliers in this program, allowing

us to significantly reduce our supply

chain costs and decrease our

working capital investment. We used

the free cash generated from this

working capital improvement and our

strong operating results, along with

an additional offering of $300 million

of senior notes in September, to

repurchase and retire almost $1 billion

of our common stock during the year.

We will continue to prudently utilize

share repurchases to return value to

our shareholders as a component of

our ongoing comprehensive capital

deployment plans, while also

remaining dedicated to maintaining

Greg Henslee

Chief Executive Officer

and Co-President

Thomas McFall

Chief Financial Officer and Executive

Vice President of Finance

Ted Wise

Chief Operating Officer

and Co-President

and improving our investment grade

credit ratings.

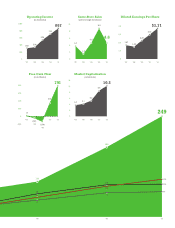

Looking Forward to 2012

Our focus on executing our proven

Dual Market Strategy and unwavering

commitment to maintaining and

living our Culture Values every day,

along with a disciplined approach to

the prudent use of capital, resulted in

a 25% increase in adjusted diluted

earnings per share in 2011. During

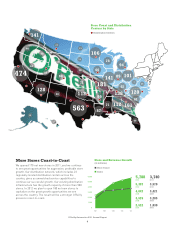

2012, we will invest in maintaining

our existing stores to ensure our

customers continue to have attractive,

clean and friendly stores to shop. We

will also expand our store base with

the opening of 180 net new stores

across the country, in both existing

and new markets, while also keeping

a close eye on the competitive

landscape for potential strategic

acquisition opportunities. As the U.S.

macro-economic environment

improves and unemployment returns

to more historic levels, we believe

the demand for auto parts will grow

with the related increase in consumer

confidence and commuter miles driven,

and we remain very well positioned

to capitalize on this opportunity.

We would like to thank all of

our shareholders for your continued

support. We remain dedicated to

generating profitable growth and

attractive returns. We will continue to

directly return value to you in the form

of share repurchases during 2012

after we have exhausted all profitable

growth opportunities. We would like

to once again thank our Team

Members whose contributions make

the Company’s success possible. We

are excited about the opportunities

that 2012 will bring, and we look

forward to discussing our results in

next year’s Annual Report.

O’Reilly Automotive 2011 Annual Report

8

Experienced Management Team

Standing: Tom McFall, Greg Henslee, David O’Reilly, Ted Wise

Seated: Mike Swearengin, Greg Johnson, Jeff Shaw, Randy Johnson