North Face 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Coalition Performance

Our Outdoor & Action Sports coalition was, once again,

one of the great highlights of 2013, with 9 percent

revenue growth. Our three largest businesses, including

The North Face®, Vans® and Timberland® brands, achieved

healthy global growth of 7 percent, 17 percent and

5 percent, respectively. There were two milestones we’re

particularly proud of: The North Face® brand passed

$2 billion in global revenues, and the Vans® brand

reached $1.7 billion in sales, putting it squarely in place

as VF’s second-largest brand. Revenue growth across

the coalition was balanced by region and channel.

In 2013, global revenues of our Jeanswear coalition were

up 1 percent over 2012. This reflected a low single-digit

percentage increase in the Americas region and a low

single-digit decline in our international business. In

the United States, revenues were negatively affected by

continued weakness in the mid-tier and mass channels,

as well as by more challenged trends in women’s basic

denim. European Jeanswear revenues were up at a low

single-digit rate, as we gained traction with our efforts

to optimize product and distribution, and connect more

effectively with consumers. And in Asia, revenues

were down 8 percent as category-specific inventory

issues tempered our full-year growth.

Imagewear is VF’s third-largest coalition, consisting

of our Image business, which includes occupational

apparel and uniforms, and our Licensed Sports Group,

which features authentic fanwear. Revenues were

down 1 percent in 2013.

VF’s Sportswear coalition had a strong year in 2013,

with revenues up 8 percent. Nautica® brand revenues

were up 5 percent, and our Kipling® brand continued

to show very strong growth, up 29 percent in the United

States. Kipling® is now VF’s seventh-largest brand.

Revenues in our Contemporary Brands coalition,

excluding the impact of the sale of the

John Varvatos®

brand in 2012, were down 2 percent in 2013 compared

with the prior year. This decrease was due to challenges

in premium denim trends, partially offset by higher

direct-to-consumer revenues from new stores and

an accelerating e-commerce business.

Our Focus: Total Shareholder Return

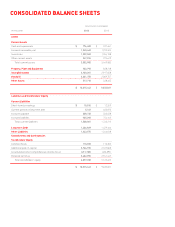

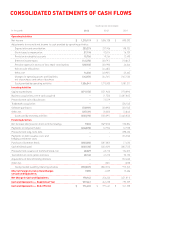

VF’s balance sheet remains very healthy. In 2013,

we repaid all short-term debt, contributed $100 million

to our pension plan, which is now nearly fully funded,

and raised our annual dividend by 21 percent. I’m pleased

to say that in 2013 we returned nearly $700 million

to you, our shareholders, in the form of dividends and

share repurchases.

Our investment thesis is simple: deliver consistent,

long-term value to shareholders by creating sustainable,

profitable growth for our brands. Backed by our unwavering

focus on providing consumers with the industry’s most

innovative apparel and footwear products and by our

proven ability to tell inspirational stories to connect them

with our brands, our confidence in the future is stronger

than it’s ever been. With another record year in the books,

we look forward to performing at an even higher level

in 2014 and beyond.

Robert K. Shearer

Senior Vice President & Chief Financial Officer

“OUR INVESTMENT THESIS IS

SIMPLE: DELIVER CONSISTENT,

LONG-TERM VALUE TO

SHAREHOLDERS BY CREATING

SUSTAINABLE, PROFITABLE

GROWTH FOR OUR BRANDS.”