Nissan 2015 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2015 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

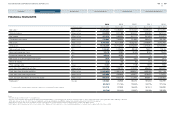

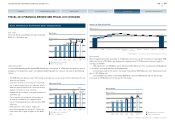

On the “management pro-forma” basis (reflecting proportional consolidation of our China Joint

Venture), we anticipate net revenues will increase by 7% to 13.27 trillion yen. Operating profit is

forecast to grow by 16.2% to 835 billion yen, resulting in an operating profit margin of 6.3%. Net

income is predicted to grow 6% to 485 billion yen.

Our financial priorities remain focused on ensuring sustainable profitable growth, generating

positive automotive free cash flow and maintaining a strong balance sheet with sufficient levels

of liquidity.

We will also continue to invest with discipline. In recent years, Nissan has invested in capacity in

key markets for the mid- to long-term. We have expanded our manufacturing capacity, and we now are

poised to take advantage of the investments made during the first half of our mid-term plan.

Overall, this means that Nissan can look ahead with confidence and remains on the right path

towards the goals of our Power 88 mid-term plan.

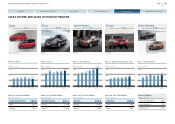

This mid-term plan will see Nissan maintain its product offensive, following on from new models

launched in the last fiscal year. We also anticipate further progress in the luxury segment through

Infiniti and in emerging markets with our entry-level Datsun brand.

These efforts coincide with continued targeted investments in new technologies, particularly

autonomous drive systems, and our continued deployment of the world’s best-selling zero-emission

electric vehicles. Progress in these areas will complement continued contributions from our Alliance

strategy, which is forecast to deliver increased synergies and global scale as we cooperate more

closely in converged functions.

Reflecting confidence in our mid-term plan and based on our healthy financial position and

outlook for fiscal year 2015, including continued solidly positive free cash flow generation, we

announced in May this year our intention to increase the dividend by 27% to 42 yen per share for

fiscal 2015.

As we’ve stated previously, our dividend policy for the remainder of the mid-term plan period

targets a minimum pay-out ratio of 30% of net income. This reflects our recognition – shared by asset

managers – that Nissan should continue to deliver an attractive return to shareholders.

In conclusion, our mid-term business plan is designed to significantly enhance shareholder value

through business growth that drives higher revenue, profits and strong sustained free cash flow

generation. We will enhance enterprise value, maintain a strong balance sheet and provide

shareholders an attractive dividend.

Success in meeting our Power 88 goals should allow Nissan to continue to enhance returns to

shareholders, realized through increased dividends and an improved market valuation.

Joseph G. Peter

Chief Financial Officer

08

NISSAN MOTOR CORPORATION ANNUAL REPORT 2015

TOP MESSAGE

CONTENTS

NISSAN POWER 88

PERFORMANCE

CORPORATE GOVERNANCE

CORPORATE FACE TIME