Nissan 2015 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2015 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

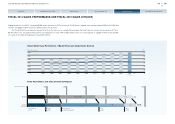

Balance sheet

Total assets increased by 15.9% to 17,045.7 billion yen compared to March 31, 2014.

Current assets increased by 19.8% to 10,317.3 billion yen compared to March 31, 2014. This was

mainly attributable to an increase in sales finance receivables by 1,279.3 billion yen.

Fixed assets increased by 10.4% to 6,728.3 billion yen compared to March 31, 2014. This was

mainly attributable to an increase in machinery, equipment and vehicles, net by 462.9 billion yen and an

increase in investment securities by 58.4 billion yen.

Current liabilities increased by 23.7% to 6,417.5 billion yen compared to March 31, 2014. This

was mainly due to increases in the current portion of long-term borrowings by 466.2 billion yen and

short-term borrowings by 316.0 billion yen. Long-term liabilities increased by 11.1% to 5,380.9 billion

yen compared to March 31, 2014. This was mainly due to increases in bonds by 176.7 billion yen and

net retirement benefit obligation by 119.7 billion yen.

Net assets increased by 12.3% to 5,247.3 billion yen compared to 4,671.5 billion yen as of March

31, 2014. This was mainly due to net income of 457.6 billion yen and a decrease in translation

adjustments by 222.4 billion yen.

Free cash flow and net cash (auto business)

For fiscal 2014, Nissan achieved a positive free cash flow of 365.8 billion yen. At the end of fiscal

2014, our net automotive cash improved from the previous fiscal year to 1,390.1 billion yen.

We continue to maintain a close focus on our inventory of new vehicles. Inventory stood at

810,000 units at the end of fiscal 2014. The company continues to manage inventory carefully in order

to limit its impact on free cash flow.

Aa3 AA–

A1 A+

A2 A

A3 A–

Baa1 BBB+

Baa2 BBB

Baa3 BBB–

Ba1 BB+

Financial Position (China JV Equity Basis)

Corporate Ratings

Long-term credit rating

Nissan’s long-term credit rating with Rating & Investment Information, Inc. (R&I) is A+ with a stable

outlook. The Standard & Poor’s (S&P) long-term credit rating for Nissan is A– with a stable outlook.

Nissan’s credit rating with Moody’s is A3 with a stable outlook.

10/03 4/04 10/04 4/05 10/05

R&I

S&P

Moody’s

4/06 10/06 4/07 10/07 4/08 10/08 4/09 10/09 4/10 10/10 4/11 7/11 7/12 1/13 9/14

14

NISSAN MOTOR CORPORATION ANNUAL REPORT 2015

PERFORMANCE

CONTENTS

TOP MESSAGE

NISSAN POWER 88

CORPORATE GOVERNANCE

CORPORATE FACE TIME