Nissan 2015 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2015 Nissan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

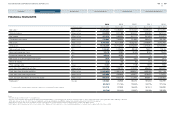

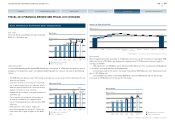

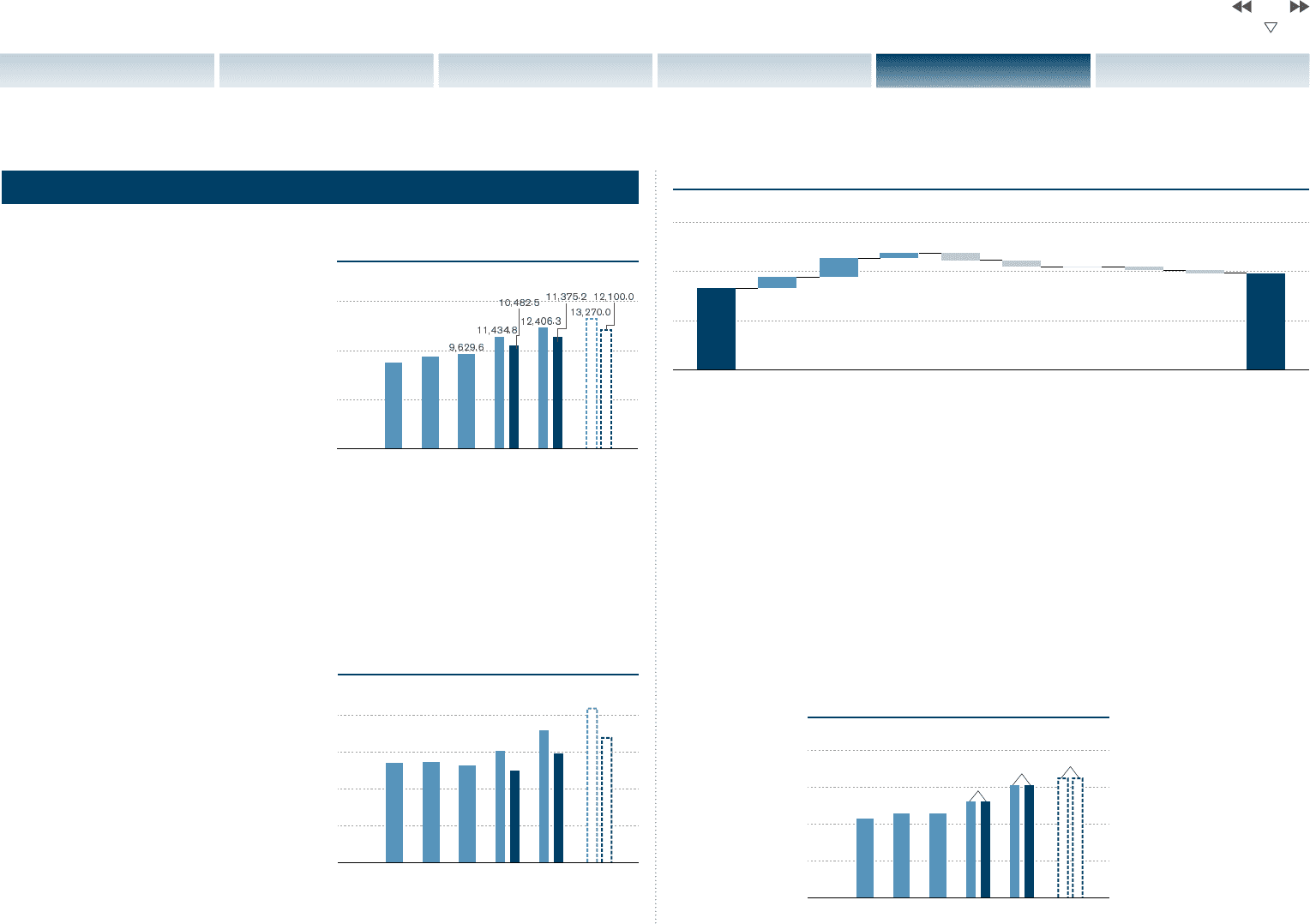

498.4

589.6

+32.4 –43.8 –39.5 –0.1 –20.1 –19.0

+68.6

+112.7

800

600

400

200

0

2015201420132010 2011 2012

537.5 545.8 523.5

605.7

498.4

718.6 675.0

589.6

835.0

(Forecast)

(Billions of yen)

(FY)

Operating Profit

(Billions of yen)

2015201420132011 2012

319.2 341.4 342.4

389.0

457.6

485.0

2010

600

450

300

150

0

(Forecast)

(Billions of yen)

(FY)

Net sales

For fiscal 2014, consolidated net sales increased

8.5%, to 11.38 trillion yen.

Operating profit

Consolidated operating profit totaled 589.6 billion yen, an increase of 18.3% from the previous year. In

comparison to the previous year’s consolidated operating profit, the variance was due to the following

factors:

l The 68.6 billion yen positive impact from foreign exchange rates came mainly from the correction of the yen

against the U.S. dollar.

l Cost items resulted in net savings of 112.7 billion

yen, as purchasing material cost-reduction efforts

were only partially offset by cost increases due to

product enrichment and raw materials.

l Volume and mix resulted in a net positive impact of

32.4 billion yen.

l The increase in marketing and selling expenses

resulted in a 43.8 billion yen negative impact.

l U.S. re-marketing performance decreased by 39.5

billion yen.

l R&D expenses increased by 0.1 billion yen.

l Manufacturing expenses rose by 20.1 billion yen.

l Other items had a negative impact of 19.0 billion

yen.

FISCAL 2014 FINANCIAL REVIEW AND FISCAL 2015 OUTLOOK

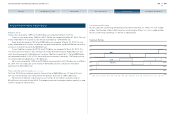

Net income

Net non-operating income amounted to 104.6 billion yen for the current fiscal year, increasing by 75.8

billion yen due to a 79.3 billion yen foreign exchange gain and 27.7 billion yen increase in equity in

earnings of affiliates.

Net special loss was 6.8 billion yen, a decrease of 9.0 billion yen. This was primarily attributable to

a 16.1 billion yen impairment loss of fixed benefits.

Income taxes paid for the current fiscal year increased by 82.2 billion yen from the previous fiscal

year to 197.3 billion yen.

Consolidated net income increased by 68.6 billion yen from 389.0 billion yen for the previous

fiscal year to 457.6 billion yen for the current fiscal year.

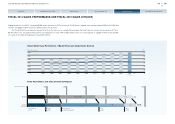

Fiscal 2014 Financial Performance (China JV Equity Basis) Impact on Operating Profit

FY13 O.P. Cost items*

* Including purch. cost reduction, raw material and product enrichment.

Marketing &

selling exp.

R&D exp.FOREX Volume/mix US

re-marketing

MFG exp. Other items FY14 O.P.

Net Income

■ Management pro forma basis*

■ China JV equity basis

■ Management pro forma basis*

■ China JV equity basis

■ Management pro forma basis*

■ China JV equity basis

2015201420132011 2012

8,773.1 9,409.0

2010

0

5,000

10,000

15,000

(Forecast)

Net Sales

(Billions of yen)

(FY)

* Based on continuation of proportionate consolidation of China JV

13

NISSAN MOTOR CORPORATION ANNUAL REPORT 2015

PERFORMANCE

CONTENTS

TOP MESSAGE

NISSAN POWER 88

CORPORATE GOVERNANCE

CORPORATE FACE TIME