Navy Federal Credit Union 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

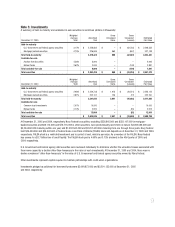

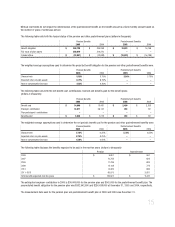

The estimated fair values of the credit union’s financial instruments are as follows

(dollars in thousands):

2005

Carrying Amount

2005

Fair Value

2004

Carrying Amount

2004

Fair Value

Financial assets:

Cash and cash equivalents $ 3,165,226 $ 3,165,226 $ 3,879,589 $ 3,879,589

Securities available-for-sale 7,891 7,891 12,915 12,915

Securities held-to-maturity 2,875,428 2,833,481 2,591,845 2,577,883

Interest-bearing deposits 579,594 569,238 655,369 654,475

Other investments 2,221 2,210 2,226 2,259

Investment in FHLB-Atlanta 26,458 26,440 26,458 26,469

Mortgage servicing assets 131,667 131,667 102,384 102,384

Mortgage loans awaiting sale 241,209 241,209 321,268 321,268

Loans, net of allowance for loan losses 16,502,095 16,282,352 14,302,380 14,379,587

Financial liabilities and equity:

Securities sold under

repurchase agreements (2,690,873) (2,691,153) (2,578,674) (2,579,129)

Members’ accounts (18,940,275) (18,293,477) (17,618,769) (17,594,131)

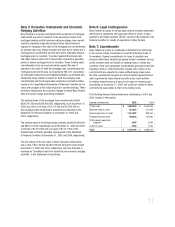

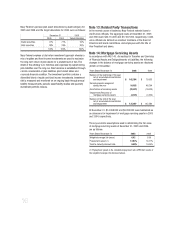

Note 17: Recently Issued Accounting

Pronouncements

In August 2005, FASB issued a proposed statement that would

amend FAS 140,

Accounting for Transfers and Servicing of Financial

Assets and Extinguishments of Liabilities.

This proposed statement

would require all separately recognized servicing rights to be initially

measured at fair value, if practicable. Furthermore, this proposed

statement would permit an entity to choose either the amortization

method or fair value method as a subsequent measurement method

for financial reporting purposes. Navy Federal will continue to

monitor the status of this exposure draft as the results could affect

the financial reporting of mortgage servicing rights in the future.

Navy Federal does not expect that the difference in a method of

measurement would have a material impact on its results of

operations or its financial condition.