Navy Federal Credit Union 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

Medical cost trends do not impact the determination of the postretirement benefit, as the benefit amount is a fixed monthly amount based on

the number of years of continuous service.

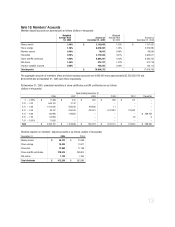

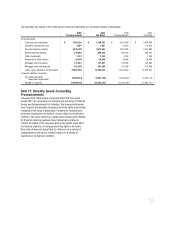

The following table sets forth the funded status of the pension and other postretirement plans

(dollars in thousands):

The weighted-average assumptions used to determine the projected benefit obligation for the pension and other postretirement benefits were:

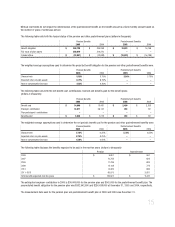

The following table sets forth the net benefit cost, contributions received and benefits paid for the benefit plans

(dollars in thousands):

The weighted-average assumptions used to determine the net periodic benefit cost for the pension and other postretirement benefits were:

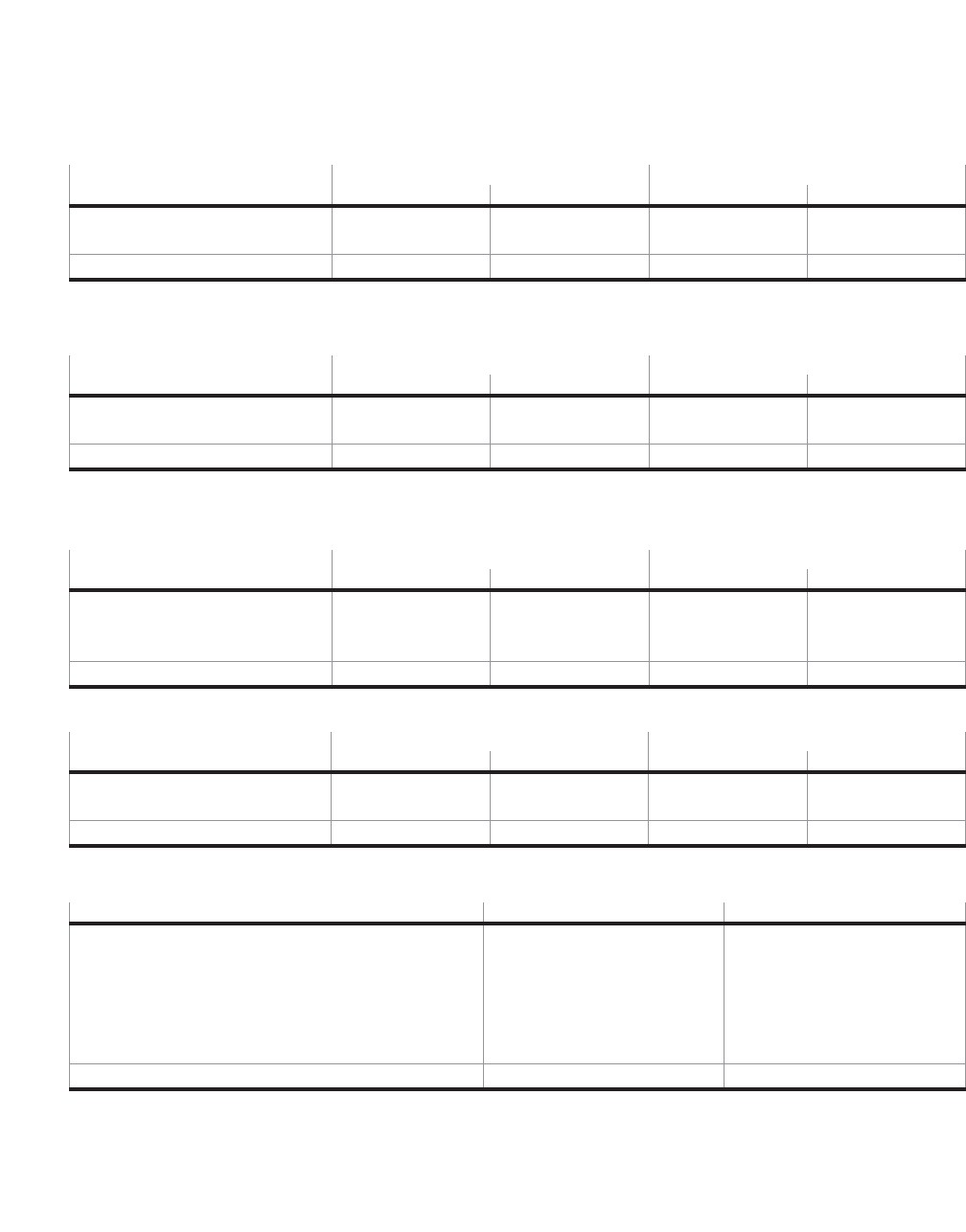

The following table discloses the benefits expected to be paid in the next ten years

(dollars in thousands)

:

The anticipated employer contribution in 2006 is $34,000,000 for the pension plan and $561,000 for the postretirement benefit plan. The

accumulated benefit obligation for the pension plan was $302,942,000 and $256,638,000 at December 31, 2005 and 2004, respectively.

The measurement date used for the pension plan and postretirement benefit plan in 2005 and 2004 was December 31.

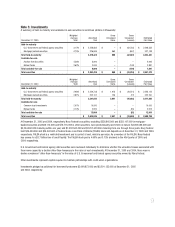

Pension Benefits Postretirement Benefits

2005 2004 2005 2004

Benefit obligation $ 388,720 $ 334,358 $ 18,923 $ 16,708

Fair value of plan assets 360,679 310,370 ––

Funded status $ (28,041) $ (23,988) $ (18,923) $ (16,708)

Pension Benefits Postretirement Benefits

2005 2004 2005 2004

Discount rate 5.50% 5.75% 5.50% 5.75%

Expected return on plan assets 8.75% 8.75% ––

Rate of compensation increase 4.50% 4.50% ––

Pension Benefits Postretirement Benefits

2005 2004 2005 2004

Benefit cost $ 14,809 $ 13,491 $ 2,499 $ 2,205

Employer contribution 34,671 36,127 203 131

Plan participants’ contributions ––––

Benefits paid $ 8,648 $ 7,219 $ 203 $ 131

Pension Benefits Postretirement Benefits

2005 2004 2005 2004

Discount rate 5.75% 6.25% 5.75% 6.25%

Expected return on plan assets 8.75% 8.75% ––

Rate of compensation increase 4.50% 4.50% ––

Pension Postretirement

2006 $ 9,901 $ 561

2007 10,755 623

2008 11,706 693

2009 13,108 774

2010 14,082 865

2011–2015 93,075 5,931

Total benefits expected, next ten years $ 152,627 $ 9,447