Navy Federal Credit Union 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

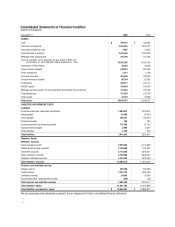

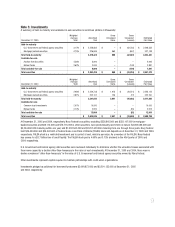

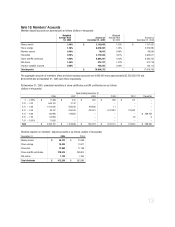

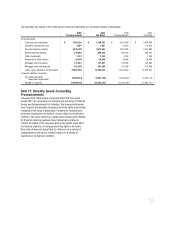

Note 3: Investments

A summary of held-to-maturity and available-for-sale securities is as follows

(dollars in thousands):

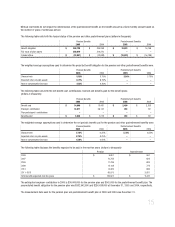

At December 31, 2005 and 2004, respectively, Navy Federal’s securities, excluding $326,845,000 and $332,107,000 in mortgage-

backed securities and $88,110,000 and $78,716,000 in other securities, were predominantly short-term in nature; $3,960,086,000 and

$4,244,068,000 maturing within one year, and $1,932,560,000 and $2,257,629,000 maturing from one through three years. Navy Federal

held $26,494,000 and $26,492,000 of Federal Home Loan Bank of Atlanta (FHLBA) stock and deposits as of December 31, 2005 and 2004,

respectively. FHLBA stock is a restricted investment and is carried at cost, which is par value. As a member of the FHLBA, Navy Federal

has access to a $3.7 billion line of credit facility. The FHLBA stock paid a 4.60% and 3.75% dividend in the 4th Quarter of 2005 and

2004, respectively.

U.S. Government and federal agency debt securities were reviewed individually to determine whether the unrealized losses associated with

them were caused by a decline other-than-temporary in the value of such investments. At December 31, 2005 and 2004, there was no

decline considered “other-than-temporary” in the value of U.S. Government and federal agency securities owned by Navy Federal.

Other investments represent capital required to maintain partnerships with credit union organizations.

Investments pledged as collateral for borrowed funds were $2,690,873,000 and $2,591,132,000 at December 31, 2005

and 2004, respectively.

December 31, 2005

Weighted

Average

Yield

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

(Losses)

Estimated

Fair Value

Held-to-maturity

U.S. Government and federal agency securities 3.17% $ 2,548,583 $–$ (42,250) $ 2,506,333

Mortgage-backed securities 4.75% 326,845 960 (657) 327,148

Total held-to-maturity 2,875,428 960 (42,907) 2,833,481

Available-for-sale

Auction Rate Securities 4.36% 5,000 – – 5,000

Mutual funds 3.62% 3,000 – (109) 2,891

Total available-for-sale 8,000 – (109) 7,891

Total securities $ 2,883,428 $ 960 $ (43,016) $ 2,841,372

December 31, 2004

Weighted

Average

Yield

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

(Losses)

Estimated

Fair Value

Held-to-maturity

U.S. Government and federal agency securities 2.96% $ 2,259,738 $ 1,915 $ (16,531) $ 2,245,122

Mortgage-backed securities 2.81% 332,107 726 (72) 332,761

Total held-to-maturity 2,591,845 2,641 (16,603) 2,577,883

Available-for-sale

Common trust investments 2.07% 10,000 – – 10,000

Mutual funds 2.70% 3,000 – (85) 2,915

Total available-for-sale 13,000 – (85) 12,915

Total securities $ 2,604,845 $ 2,641 $ (16,688) $ 2,590,798