Navy Federal Credit Union 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

easily convert a line

of credit to a fixed-

rate loan.

Continued low

rates kept mortgage

lending strong with

more than 40,600

loans approved for approximately $9 billion.

Also spurring demand were higher limits

of up to $2 million and the introduction of

our HomeBuyers Choice mortgage, which

requires no down payment and no private

mortgage insurance (PMI).

We said “yes” to 441,500 consumer

loan applications for more than $5 billion.

Approximately 182,000 credit card accounts

were approved for $630 million, an increase

of 61%. Finally, 172,000 members took to

the road in new vehicles in 2005 with loans

totaling $2.9 billion, a 13% increase.

Navy Federal granted $4.3 million in

special expedited emergency relief loans to

Your Credit Committee is dedicated to

providing the best possible loan solutions for

all members, offering low rates, convenient

products and services, and programs that

accommodate both the first-time borrower

and those with established credit histories.

Approximately 720,000 member requests

for credit were approved in 2005 for a total

of more than $18 billion.

Extraordinary demand for equity loans

continued for the second consecutive year.

Over 54,000 were approved for more than

$3 billion, surpassing the 2004 record by

50%. Members responded enthusiastically

to such benefits as no closing costs, higher

loan limits, longer terms and the option to

members who suffered losses from natural

disasters across the country, particularly

Hurricane Katrina victims.

Responsive member service is reinforced

by the Credit Committee’s commitment to

preserve the safety and soundness of the

credit union. We also provide the information

members need to manage their credit well

and become savvy borrowers while reaching

their lifelong financial goals.

Denise S. Holmes

Chairperson

26

credit

committee

navy federal report to members 2005

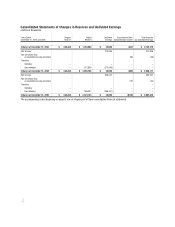

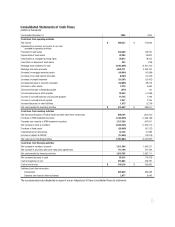

2005 Approvals

Type of Loan # Approved % Change $ Approved % Change

Consumer 441,474 2.9% $5,367.8 10.5%

Mortgage 40,634 (9.6%) $8,786.8 0.1%

Equity 54,003 49.8% $3,312.0 93.6%

Credit Cards 181,804 16.6% $630.0 61.2%

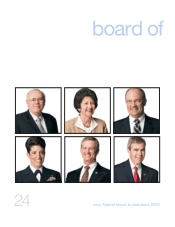

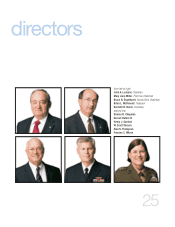

from left to right

Denise S. Holmes, Chairperson

Kenneth R. Burns

Robert J. Griffin

Joan C. Cox

Jerry W. Turner