Navy Federal Credit Union 2005 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2005 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

navy federal report to members 2005

vision statement

Navy Federal will perform with such

excellence that all present and potential

members will choose Navy Federal as

the preferred source for their primary,

lifetime financial services.

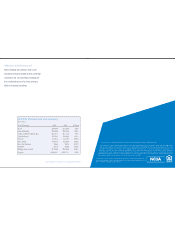

2005 financial summary

Dollars in millions

As of 31 December 2005 2004 % Change

Assets $24,644.4 $22,896.9 7.63%

Loans Outstanding $16,944.4 $14,785.5 14.60%

Shares, Sharechek®, MMSAs, IRAs $13,787.2 $12,772.0 7.95%

Share Certificates $5,153.1 $4,846.8 6.32%

Reserves $2,692.4 $2,426.1 10.98%

Gross Income $1,612.3 $1,360.3 18.53%

Non-interest Expenses $596.5 $541.6 10.14%

Dividends $412.3 $363.0 13.58%

Mortgage Loans Serviced $17,936.8 $15,403.9 16.44%

Members 2,665,859 2,515,174 5.99%

This credit union is federally insured by the National Credit Union Administration. Copyright © 2006 Navy Federal

Representatives are registered through, and securities are sold through, CUNA Brokerage Services, Inc. (CBSI), a member NASD/SIPC, 2000 Heritage

Way, Waverly, Iowa 50677, toll-free (866) 512-6109. Insurance sold through licensed CUNA Mutual Life Insurance Company Representatives, and in

New York, licensed insurance representatives of other companies. CUNA Brokerage Services, Inc., is a registered broker/dealer in all fifty states of the

United States of America. Trust services available through MEMBERS Trust Company, 14025 Riveredge Drive, Suite 280, Tampa, FL 33637. Nondeposit

investment products are not federally insured, are not obligations of the credit union, are not guaranteed by the credit union or any affiliated entity, involve

investment risks, including the possible loss of principal, and may be offered by an employee who serves both functions of accepting members’ deposits

and the selling of nondeposit investment products. Settlement Services offered by NFRES.

Personal and business insurance products offered through Navy Federal Financial Group, LLC, a

wholly owned subsidiary of Navy Federal Credit Union, are offered through Newtek Insurance Agency,

which is not affiliated with Navy Federal Credit Union.