Navy Federal Credit Union 2005 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2005 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

Amortization of mortgage servicing assets is based on a method which

approximates the ratio of net servicing income received in the current

period to total net servicing income projected to be realized from the

mortgage servicing assets. Mortgage servicing assets are evaluated

for impairment based on the excess of the carrying amount of the

mortgage servicing assets over their fair value. For purposes of

measuring impairment, mortgage servicing assets are stratified on

the basis of loan type and term.

Derivative Financial Instruments

In compliance with FAS 133,

Accounting for Derivative Instruments

and Hedging Activities,

all derivative financial instruments are

recognized on the balance sheet at fair value. Changes in the fair

value of derivative financial instruments are recorded in current

earnings. See Note 5 for further information on Navy Federal’s use

of derivative financial instruments.

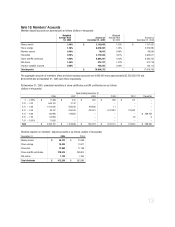

Members’ Accounts

Members’ accounts are classified as equity to denote the ownership

interest of the members in Navy Federal. The American Institute

of Certified Public Accountants opined that credit union savings

accounts should be classified as liabilities consistent with the

prevailing practice in mutually owned savings and loan associations

and banks. Navy Federal does not agree with this opinion and

believes that the AICPA did not consider that credit unions are

fundamentally dissimilar to such institutions, which (for example)

accept deposits from the general public and are not democratically

controlled by their “owners.”

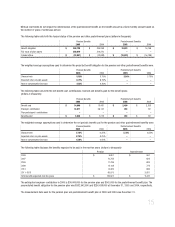

Reserve Requirement

In 2001, the NCUA no longer required credit unions that are

classified as “well capitalized” (7% or higher net worth ratio) to

make statutory transfers to the regular reserve. The regular reserve

is not available for the payment of dividends. The capital reserve

has been established at the discretion of the Board of Directors

to protect the interests of the members.

Retirement Benefits and Pension Accounting

Navy Federal has defined benefit pension plans, 401(k) and 457(b)

savings plans and a non-qualified supplemental retirement plan.

Navy Federal also provides a contributory group medical plan for

retired employees.

Navy Federal accounts for its defined benefit pension plans

in accordance with FAS 87,

Employers’ Accounting for Pensions.

Non-pension postretirement benefits are accounted for in accor-

dance with FAS 106,

Employers’ Accounting for Postretirement

Benefits Other Than Pensions.

In 2004, Navy Federal adopted

FAS 132,

Employers’ Disclosures about Pensions and Other

Postretirement Benefits.

Income Taxes

Pursuant to the Federal Credit Union Act, Navy Federal is exempt

from the payment of Federal and state income taxes; however,

NFFG is subject to Federal and state income taxes. NFFG incurred a

tax liability of $588,000 in 2005 for Federal and state income taxes

and NFFG paid $116,000 in Federal and state taxes in 2004. No tax

payment was made in 2005 because NFFG was able to offset their

tax liability with a deferred tax asset.

Deferred Income Taxes

Deferred income tax assets are recognized to the extent that it is

probable that future taxable profit will be available against which

the temporary differences can be utilized. NFFG reported a deferred

tax asset of $0 and $379,000 in 2005 and 2004, respectively.

Dividends

Dividend rates on members’ accounts are set by the Board of

Directors and dividends are charged to operations. Dividends on

all share products are paid monthly.

Reclassifications

Certain amounts in the 2004 Consolidated Financial Statements

have been reclassified to conform to the 2005 presentation.

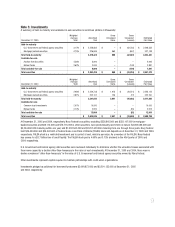

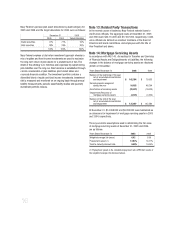

Note 2: Restrictions on Cash

Navy Federal is required to maintain balances with corporate credit

unions that are classified as membership shares that are uninsured

and require a three-year notice before withdrawal. The required

balance for Navy Federal at December 31, 2005 and 2004 was

$18,761,000 and $21,554,000, respectively.

The Board of Governors of the Federal Reserve System (FRB)

requires Navy Federal to maintain a cash reserve balance to cover

transactions processed by the FRB for Navy Federal. At December 31,

2005 and 2004, Navy Federal’s clearing balance requirement was

$60,000,000 and $180,000,000, respectively.

In February 2004, Navy Federal Financial Group set aside $1 million

as non-current restricted cash as part of the agreement it entered into

with Charlie Mac, LLC. NFFG continued to set $1 million aside as non-

current restricted cash in 2005. See Note 1 for further information.