NVIDIA 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

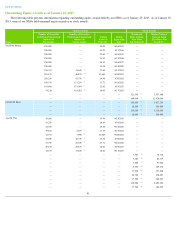

Equity Compensation Plan Information

The number of shares issuable upon exercise of outstanding stock options, RSUs and PSUs, the weighted-

average exercise price of

outstanding stock options, and the number of stock awards remaining for future issuance under each of our equity compensation plans as of

January 25, 2015 are summarized as follows:

__________

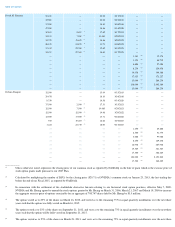

PortalPlayer, Inc. 2004 Stock Incentive Plan

We assumed the 2004 Plan and all related outstanding options in connection with our acquisition of PortalPlayer, Inc. in January 2007. The

2004 Plan was adopted by the PortalPlayer stockholders in 2004. Each option we assumed in connection with our acquisition of PortalPlayer has

been converted into the right to purchase that number of shares of NVIDIA common stock determined by multiplying the number of shares of

PortalPlayer common stock underlying such option by 0.3601 and then rounding down to the nearest whole number of shares. The exercise price

per share for each assumed option has been similarly adjusted by dividing the exercise price by 0.3601 and then rounding up to the nearest whole

cent. Vesting schedules and expiration dates for the assumed options did not change. Under the 2004 Plan, options generally vest as to 25% of

the shares one year after the date of grant and as to 1/48

th

of the shares each month thereafter and expire ten years from the date of grant. We no

longer make option grants from this plan.

PortalPlayer, Inc. 1999 Stock Option Plan

We assumed options issued under the 1999 Plan when we completed our acquisition of PortalPlayer in January 2007. The 1999 Plan was

terminated upon completion of PortalPlayer’

s initial public offering of common stock in 2004. Each option we assumed in connection with our

acquisition of PortalPlayer has been converted into the right to purchase that number of shares of NVIDIA common stock determined by

multiplying the number of shares of PortalPlayer common stock underlying such option by 0.3601 and then rounding down to the nearest whole

number of shares. The exercise price per share for each assumed option has been similarly adjusted by dividing the exercise price by 0.3601 and

then rounding up to the nearest whole cent. Vesting schedules and expiration dates did not change. Under the 1999 Plan, options generally vest

as to 25% of the shares one year after the date of grant and as to 1/48

th

of the shares each month thereafter and expire ten years from the date of

grant.

50

Plan Category

Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a)

Weighted-average

exercise price of

outstanding

options, warrants

and rights ($)

(b)

Number of securities

remaining available for

future issuance under equity compensation

plans (excluding securities reflected in

column (a))

(c)

Equity compensation plans approved by

security holders

(1)

21,342,004

14.60

(2)

76,949,849

(3)

Equity compensation plans not approved

by security holders

(4)

2,713

36.59

(2)

—

Total

21,344,717

14.61

(2)

76,949,849

(3)

(1)

This row includes our 2007 Plan (which is intended as the successor to and continuation of our 1998 Plan, our 1998 Non-

Employee

Directors’

Stock Option Plan, our 2000 Nonstatutory Equity Incentive Plan and the 2004 Plan) and our 2012 ESPP. Under our 2012

ESPP, participants are permitted to purchase our common stock at a discount on certain dates through payroll deductions within a pre-

determined purchase period. Accordingly, these numbers are not determinable.

(2)

Represents the weighted-

average exercise price of outstanding stock options only.

(3)

The number of shares that remained available for future issuance as of January 25, 2015 is as follows:

Plan Number of shares remaining available for future issuance or for the

grant of future rights as of January 25, 2015

2007 Plan

24,501,781

2012 ESPP

52,448,068

Total

76,949,849

(4)

This row represents the 2004 Plan and the 1999 Plan, which are described below.