NVIDIA 2014 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2014 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

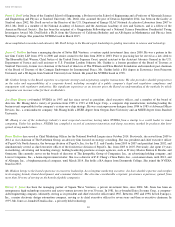

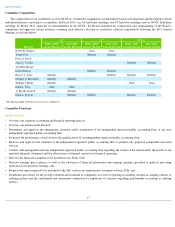

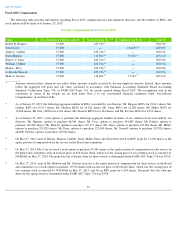

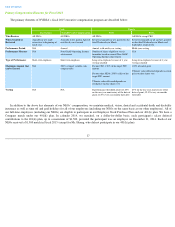

Fiscal 2015 Compensation

The following table provides information regarding Fiscal 2015 compensation for non-

employee directors, and the number of RSUs and

stock options held by them as of January 25, 2015:

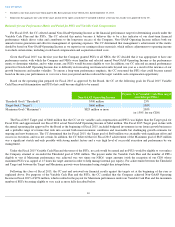

Director Compensation for Fiscal Year 2015

__________

20

Name Fees Earned or Paid in Cash ($) Stock Awards ($)

(1) (2)

Option Awards ($)

(1) (3)

Total ($)

Robert K. Burgess 75,000 225,726

(4)

— 300,726

Tench Coxe 75,000 — 154,697

(5)

229,697

James C. Gaither 75,000 225,726

(4)

— 300,726

Dawn Hudson 75,000 112,863

(6)

77,347

(6)

265,210

Harvey C. Jones 75,000 225,726

(4)

— 300,726

William J. Miller 75,000 225,726

(4)

— 300,726

Mark L. Perry 75,000 225,726

(4)

— 300,726

A. Brooke Seawell 75,000 225,726

(4)

— 300,726

Mark A. Stevens 75,000 112,863

(6)

77,347

(6)

265,210

(1)

Amounts shown in this column do not reflect dollar amounts actually received by the non-

employee director. Instead, these amounts

reflect the aggregate full grant date fair value calculated in accordance with Financial Accounting Standards Board Accounting

Standards Codification Topic 718, or FASB ASC Topic 718, for awards granted during Fiscal 2015. The assumptions used in the

calculation of values of the awards are set forth under Note 2 to our consolidated financial statements titled “Stock-

Based

Compensation” in our Form 10-K.

(2)

As of January 25, 2015, the following aggregate number of RSUs were held by our directors: Mr. Burgess, RSUs for 23,411 shares; Mr.

Gaither, RSUs for 29,515 shares; Ms. Hudson, RSUs for 10,262 shares; Mr. Jones, RSUs for 12,208 shares; Mr. Miller, RSUs for

12,208 shares; Mr. Perry, RSUs for 6,104 shares; Mr. Seawell, RSUs for 6,104 shares; and Mr. Stevens, RSUs for 3,052 shares.

(3)

As of January 25, 2015, stock options to purchase the following aggregate number of shares of our common stock were held by our

directors: Mr. Burgess, options to purchase 66,041 shares; Mr. Coxe, options to purchase 294,885 shares; Mr. Gaither, options to

purchase 122,269 shares; Ms. Hudson, options to purchase 105,177 shares; Mr. Jones, options to purchase 167,820 shares; Mr. Miller,

options to purchase 255,820 shares; Mr. Perry, options to purchase 123,000 shares; Mr. Seawell, options to purchase 207,820 shares;

and Mr. Stevens, options to purchase 120,942 shares.

(4)

On May 27, 2014, each of Messrs. Burgess, Gaither, Jones, Miller, Perry and Seawell received an RSU grant for 12,208 shares as the

equity portion of compensation for his service on the Board and committees.

(5)

On May 27, 2014, Mr. Coxe received a stock option to purchase 39,065 shares as the equity portion of compensation for his service on

the Board and committees with an exercise price of $18.82 per share, which was the closing price of our common stock as reported by

NASDAQ on May 27, 2014. The grant date fair value per share for these awards as determined under FASB ASC Topic 718 was $3.96.

(6)

On May 27, 2014, each of Ms. Hudson and Mr. Stevens received as the equity portion of compensation for their service on the Board

and committees (a) a stock option to purchase 19,532 shares with an exercise price of $18.82 per share, which was the closing price of

our common stock as reported by NASDAQ on May 27, 2014, and (b) an RSU grant for 6,104 shares. The grant date fair value per

share for the option award as determined under FASB ASC Topic 718 was $3.96.