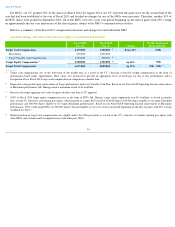

NVIDIA 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Rationale for our Performance Metric and Period for PSUs and Variable Cash Compensation

For Fiscal 2015, the CC selected annual Non-

GAAP Operating Income as the financial performance target for determining awards under the

Variable Cash Plan and the PSUs. The CC selected this metric because it believes this to be a key indicator of our short-

term financial

performance which drives value and contributes to the long-term success of the Company. Non-

GAAP Operating Income reflects both our

annual revenue generation and effective management of operating expenses. The CC determined that management’

s achievement of this metric

should be based on Non-

GAAP Operating Income as we report in our earnings release materials, which reflects adjustments to operating income

to exclude certain items, including stock-based compensation and acquisition-related costs.

Given that Fiscal 2015 was the first year that the Company granted PSUs to all NEOs, the CC decided that it was appropriate to have one

performance metric with which the Company and NEOs were familiar and selected annual Non-

GAAP Operating Income as the performance

metric to determine whether, and to what extent, any PSUs would become eligible to vest. In addition, our CC selected an annual performance

period for Non-

GAAP Operating Income due to difficulty in forecasting our financial results beyond one year as a result of the newness of our

growth businesses and market volatility. To ensure a long-

term performance emphasis, the CC structured the PSUs that could become earned

based on the one-year performance to vest over a four-year period and also reduced the target variable cash compensation opportunity.

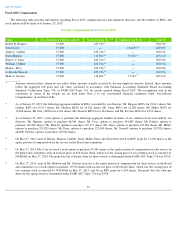

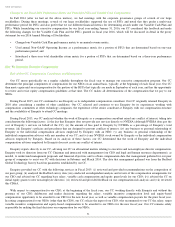

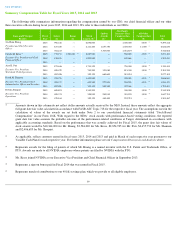

Based on the operating plan prepared for Fiscal 2015 as approved by the Board, the CC set the following goals for Fiscal 2015 Variable

Cash Plan award determination and PSUs that could become eligible to be earned:

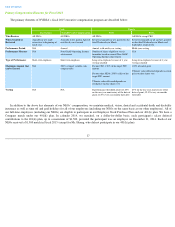

The Fiscal 2015 Target goal of $660 million that the CC set for variable cash compensation and PSUs was higher than the Target goal for

Fiscal 2014 and approximated our Fiscal 2014 actual Non-

GAAP Operating Income of $664 million. The Fiscal 2015 Target goal, in line with

the annual operating plan approved by the Board at the beginning of Fiscal 2015, included budgeted investments in our future growth businesses

and a probable range of revenue that took into account both macroeconomic conditions and reasonable but challenging growth estimates for

ongoing and new businesses. The CC determined that for Fiscal 2015, the Target goal of $660 million was attainable with significant effort and

success in execution, and was not certain. In addition, the CC believed that for Fiscal 2015 achievement of the Maximum goal of $825 million

was a significant stretch and only possible with strong market factors and a very high level of successful execution and performance by our

management.

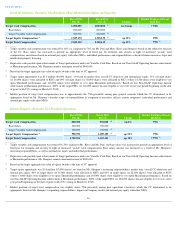

Under the Fiscal 2015 Variable Cash Plan and the terms of the PSUs, no cash would be earned and no PSUs would be eligible to vest unless

the Company attained or exceeded the Threshold goal of $500 million. The payout under the Variable Cash Plan and the number of PSUs

eligible to vest if Maximum performance was achieved was two times our NEOs’

target amounts (with the exception of our CEO whose

maximum PSUs was capped at 1.5 times his target amount in order to help manage internal pay equity). For achievement between the Threshold

and Target and between the Target and Maximum, payouts were determined using straight-line interpolation.

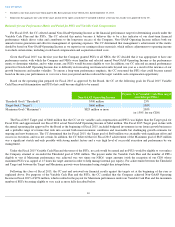

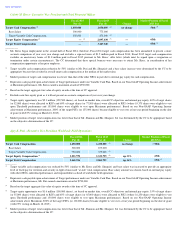

Following the close of Fiscal 2015, the CC met and reviewed our financial results against the targets set at the beginning of the year as

explained above. For purposes of the Variable Cash Plan and the PSUs, the CC certified that the Company achieved Non-

GAAP Operating

Income in Fiscal 2015 of $954 million, which resulted in the payout for Maximum performance under our Variable Cash Plan and the maximum

number of PSUs becoming eligible to vest, each as more fully described below.

30

(3)

Excludes a one-

time anniversary bonus paid to Ms. Kress pursuant to her Offer Letter, dated September 13, 2013.

(4)

Represents the aggregate fair value of the target amount of the equity awards the CC intended to deliver at the time the awards were approved by the CC.

Non-GAAP Operating Income

Payout (% of Variable Cash Plan target

award/target PSUs)

Threshold Goal (“Threshold”) $500 million 25%

Target Goal (“Target”) $660 million 100%

Maximum Goal (“Maximum”) $825 million or more 200%

(or 150% for our CEO)