NVIDIA 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

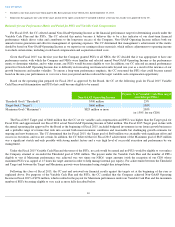

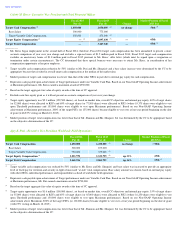

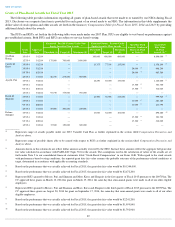

Compensation Actions for Fiscal 2015

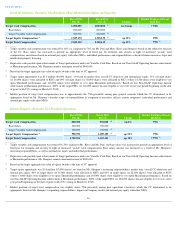

Total Target Compensation Approach

In making Fiscal 2015 compensation decisions, for each NEO our CC reviewed the total target cash opportunity (base salary plus variable

cash compensation), target equity compensation opportunity and total target pay for similarly situated executives of our peer companies. The CC

considered the factors discussed in Factors Used in Determining Executive Compensation above, the CC’

s specific compensation objectives for

Fiscal 2015 as outlined in Fiscal 2015 Compensation Changes above and the CEO’

s recommendation for NEOs (other than himself). Our CC

did not use a formula or assign a particular weight to any one factor in determining each NEO’s target pay. Rather, our CC’

s determination of the

total target compensation, mix of cash and equity and fixed and variable pay opportunities was subjective for each NEO and the CC’

s overall

objectives for total pay positioning and balancing the pay mix as discussed above. In making compensation decisions, the CC did not review and

consider each element of pay independently; rather, it was reviewed in the context of overall target pay opportunity for each NEO. Accordingly,

when the CC made changes to one element of pay, those changes were made primarily in the context of the levels of the other elements of pay,

and resulting total target pay for such NEO. Generally, except in the case of our CEO (as described below), resulting total target compensation

for the NEOs was above the median of the market data (but not above the 75th percentile) as a result of the significant target equity opportunity

awarded to each NEO. In approving this structure, the CC was mindful that these equity awards would only be realized at above-

market levels

upon exceptional performance. To reflect the CC’

s process in making compensation decisions for Fiscal 2015, the summary below describes, for

each NEO separately, the three primary components of Fiscal 2015 compensation and compensation changes for such NEO.

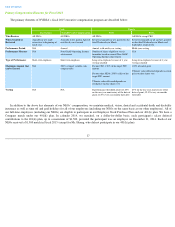

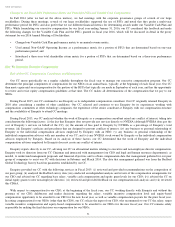

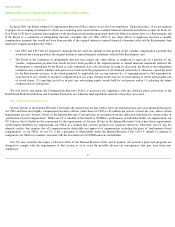

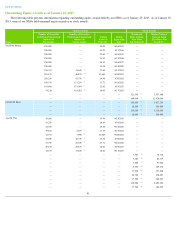

Shift Towards Long-Term Performance-Based Awards

The CC determined that for all NEOs, long-term, performance-

based equity awards granted in Fiscal 2015 would comprise a meaningful

portion of their Fiscal 2015 total target compensation (and more so than in Fiscal 2014) and accordingly each NEO received a greater portion of

total target compensation for Fiscal 2015 in the form of equity awards. In order to effectuate the emphasis on long-

term equity awards, while

maintaining total target direct compensation at a reasonable and appropriate level for each NEO, the CC reduced each NEO’

s target

compensation under the Variable Cash Plan by approximately 50% (which fluctuated by individual based on the subjective decision of the CC).

The CC felt that this adjustment was appropriate because of the introduction of PSUs for all NEOs, which were dependent in part on meeting the

same objective performance goal as the Variable Cash Plan, and therefore the CC believed our NEOs were sufficiently motivated to work

towards achieving such goal. In addition, the CC felt the increase in base salaries for all of our NEOs provided an appropriate balance to the

reduced Variable Cash Plan compensation. As described above, the CC’s overall goal was to enhance long-

term opportunity to drive results and

increase alignment with stockholders while maintaining a sufficient level of cash for competitive and retentive purposes. The PSUs and RSUs

delivered additional long-term incentive and retentive benefits (that the annual cash incentive lacked) by vesting over a four-

year period, to the

extent the performance goal was attained (for PSUs) and to the extent the NEO remained in service with us (for PSUs and RSUs).

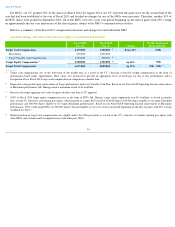

The CC determined a target equity opportunity value that it wanted to deliver to each NEO in Fiscal 2015 based on the factors described

above. Generally, this target equity opportunity fell at the higher end of peer data, which the CC determined was appropriate based on the CC’

s

emphasis on long-term performance-based compensation and allowing for above-

market rewards for exceptional performance. To determine

actual shares awarded based on the target opportunity, the CC reviewed the 90-

day trailing average of our stock price to smooth for daily

volatility to inform it on the number of shares to deliver for RSUs and the target number of shares to deliver for PSUs. In line with its goal of

increasing the proportion of performance-

based pay, the CC decided to deliver a greater portion of equity awards in the form of PSUs than

RSUs. For each NEO other than Mr. Huang, the CC delivered roughly 60% of the target equity opportunity in the form of PSUs and 40% of the

target equity opportunity in the form of RSUs, which percentages fluctuated by NEO based on individual adjustments as determined by the CC.

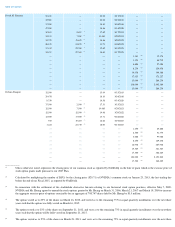

For PSUs, the target number of shares awarded to each NEO represented the number of shares eligible to vest upon achievement of Target

performance on the Non-

GAAP Operating Income goal for Fiscal 2015. For each of our NEOs, the minimum number of shares eligible to vest

was 25% of the target number of shares if Threshold performance was achieved and the maximum number of shares eligible to vest was capped

at 200% of the target number of shares (or 150% for Mr. Huang) if Maximum performance was achieved. No shares were eligible to vest if

Threshold performance was not achieved. If at least Threshold performance was achieved, 25% of the eligible shares would vest on the one year

anniversary of the grant date and 12.5% of the eligible shares would vest every six months thereafter over the next three years, subject to the

NEO

’s continued service with us. Additional information about the PSUs and the performance metric thereunder is discussed in

How and Why

we Chose our Performance Metric and Period for PSUs and Variable Cash Compensation above.

33