NVIDIA 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

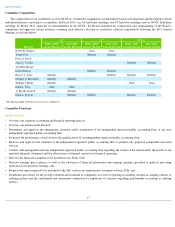

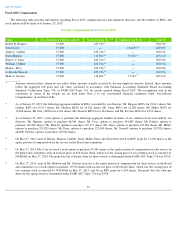

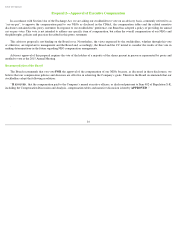

Important Features of our Compensation Program

Below are important elements of our compensation program we have adopted, and problematic pay practices that we avoid:

26

What We Do What We Don’t Do

4

4 4

4

Heavily weight our NEO compensation toward “at-risk” performance-

based compensation, consisting of equity awards and variable cash

compensation

5

5 5

5

Have employment contracts or severance agreements providing for a

specific term of employment or severance benefits with any of our

executive officers

4

4 4

4

Use multi-year vesting terms for all executive officer equity awards

5

5 5

5

Provide change-in-control benefits to our executive officers

4

4 4

4

Engage with our stockholders and corporate governance groups to

discuss our executive compensation programs, carefully consider their

input and make changes to our pay practices based on their feedback

5

5 5

5

Provide for automatic equity vesting upon a change-in-control except

for the provisions in our equity plans that are applicable to all of our

employees if an acquiring company does not assume or substitute our

outstanding stock awards

4

4 4

4

Structure our executive compensation programs to minimize

inappropriate risk-taking

5

5 5

5

Provide tax gross-ups

4

4 4

4

Cap PSUs and incentive award levels under the annual Variable Cash

Plan

5

5 5

5

Offer our executive officers any supplemental retirement benefits or

perquisites that are not available to all NVIDIA employees

4

4 4

4

Rigorously administer our compensation program, including review of

peer group practices, advice by an independent compensation

consultant reporting directly to our CC, and long-standing,

consistently-applied practices regarding the timing of equity grants

5

5 5

5

Allow for the repricing of stock options without stockholder approval

4

4 4

4

Have meaningful stock ownership guidelines for our executive officers

5

5 5

5

Use discretion in performance incentive award determination

4

4 4

4

Enforce a “no-hedging” policy and a “no-pledging” policy that does

not allow our executive officers to hedge the economic interest in the

NVIDIA shares they hold or pledge NVIDIA shares as collateral

4

4 4

4

Maintain a “clawback” policy for the recovery of performance-based

cash and equity compensation in the event of a financial restatement

that does not require individual misconduct to be enforced against our

executive officers

4

4 4

4

Review the external marketplace and make internal comparisons

among the executive officers when making compensation

determinations

4

4 4

4

Have three or more independent non-employee directors serve on the

CC, which engages an independent consultant to provide advice and

counsel on market trends, executive pay practices and regulatory

developments