NVIDIA 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

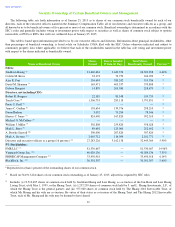

Fiscal 2015 Compensation Changes

In setting Fiscal 2015 NEO compensation, our CC reflected on the votes cast on our say-on-

pay proposal for Fiscal 2014. At our 2014

Annual Meeting, nearly 98% of the votes cast on our say-on-

pay proposal were in support of the compensation paid to our NEOs for Fiscal

2014. While this vote was only advisory and not binding, our CC carefully considered the results of the vote in the context of our overall

compensation philosophy, as well as our compensation policies and decisions. Our CC also considered the feedback that our management

received when meeting with the corporate governance departments of our large stockholders in Fall 2013 (in advance of making compensation

decisions for Fiscal 2015).

The only changes made to our Fiscal 2015 executive compensation program since our stockholders overwhelmingly supported our Fiscal

2014 executive compensation program were the following, intended to further the specific objectives listed below:

28

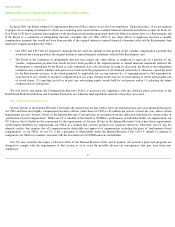

• We granted 100% of our CEO’

s equity compensation in the form of PSUs

◦

In years prior to Fiscal 2014, Mr. Huang was awarded stock options only. In Fiscal 2014, Mr. Huang was awarded a

combination of PSUs and stock options.

◦ In Fiscal 2015, all of Mr. Huang’

s equity compensation was awarded in the form of PSUs.

•

We introduced PSUs for all of our other NEOs

◦

In Fiscal 2014, our NEOs (other than our CEO as discussed above) received a combination of stock options and RSUs.

◦

In Fiscal 2015, our NEOs (other than our CEO as discussed above) received a combination of PSUs and RSUs, weighted

roughly 60% toward PSUs.

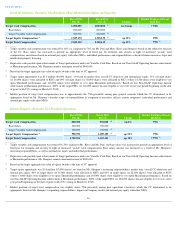

• We revised our Variable Cash Plan so that 100% of our NEOs’ variable cash opportunity is tied to NVIDIA’

s financial

operating performance

◦ In Fiscal 2014, up to 50% of each NEO’s total variable cash target award opportunity was based on the Company’

s

achievement of a corporate financial performance target and up to another 50% was based on the NEO’

s achievement against

his or her individual objectives.

◦ In Fiscal 2015, 100% of each NEO’s total variable cash target award opportunity was based on the Company’

s achievement of

a corporate financial performance target; therefore, an NEO may no longer earn a payout under our Variable Cash Plan if the

Company does not meet its key financial and operational performance goals.

•

We increased emphasis on equity compensation as a percentage of total target pay

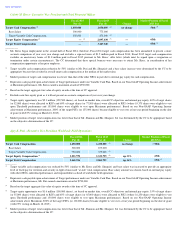

◦ In Fiscal 2014, 33% of our CEO’

s total target pay was in the form of cash and 67% was in the form of equity, specifically a

combination of PSUs and stock options. In addition, 50% of our other NEOs' total target pay was in the form of cash and 50%

was in the form of equity, specifically a combination of RSUs and stock options. A substantial portion of overall cash

compensation was allocated to target variable cash compensation for each NEO.

◦

In Fiscal 2015, our CC assigned a greater emphasis on equity compensation as a percentage of overall target pay, resulting in

21% of our CEO’

s total target pay being in the form of cash and 79% in the form of equity, specifically PSUs. For our other

NEOs, 39% of total target pay was in the form of cash and 61% was in the form of equity, specifically a combination of PSUs

and RSUs. Given the CC's goal of delivering a substantial portion of overall pay in the form of "at-

risk" pay and delivering this

"at-risk" pay primarily in the form of long-

term equity grants, the CC reduced the target annual variable cash compensation

each NEO was eligible to earn to preserve a reasonable competitive total pay position. A larger portion of overall target cash

was allocated to base salary as the CC supported the philosophy of balancing cash and equity as well as fixed and variable pay

for NEOs.