NVIDIA 2012 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

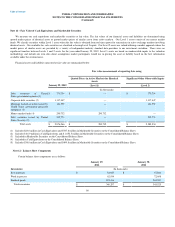

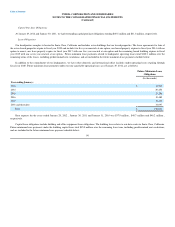

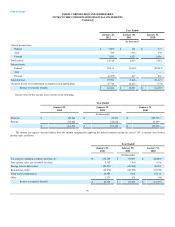

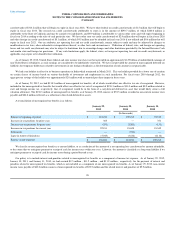

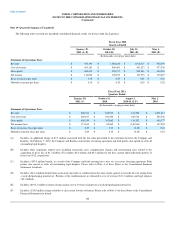

Year Ended

January 29,

2012 January 30,

2011 January 31,

2010

(In thousands)

Current income taxes:

Federal $ 7,099 $ 141 $ 177

State 789 (511) 438

Foreign 7,630 6,827 6,966

Total current 15,518 6,457 7,581

Deferred taxes:

Federal 25,111 (3,063) (22,013)

State — — —

Foreign (6,055) 417 866

Total deferred 19,056 (2,646) (21,147)

Charge in lieu of taxes attributable to employer stock option plans 47,732 14,212 (741)

Income tax expense (benefit) $ 82,306 $ 18,023 $ (14,307)

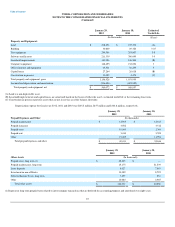

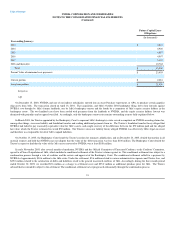

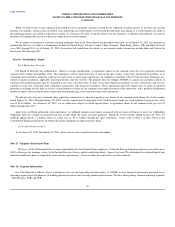

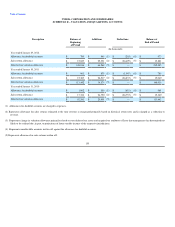

Income (loss) before income taxes consists of the following:

Year Ended

January 29,

2012 January 30,

2011 January 31,

2010

(In thousands)

Domestic $ 120,768 $ 82,531 $ (105,793)

Foreign 542,628 188,638 23,499

$ 663,396 $ 271,169 $ (82,294)

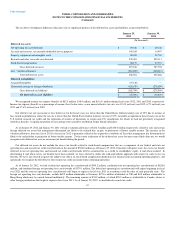

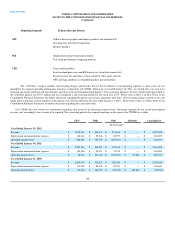

The income tax expense (benefit) differs from the amount computed by applying the federal statutory income tax rate of 35% to income (loss) before

income taxes as follows:

Year Ended

January 29,

2012 January 30,

2011 January 31,

2010

(In thousands)

Tax expense computed at federal statutory rate $ 232,189 $ 94,909 $ (28,803)

State income taxes, net of federal tax effect 2,302 (391) (196)

Foreign tax rate differential (142,071) (49,585) 26,902

Research tax credit (24,270) (28,729) (22,270)

Stock-based compensation 10,983 1,668 10,114

Other 3,173 151 (54)

Income tax expense (benefit) $ 82,306 $ 18,023 $ (14,307)

96