NVIDIA 2012 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

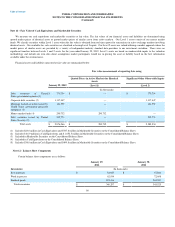

Fair Value Determination

In determining the estimated fair value of the elements of the License Agreement, we assumed the highest and best use of each element from a market

participant perspective. The inputs and assumptions used in our valuation included projected revenue, royalty rates, discount rates, useful lives and income tax

rates, among others. The development of a number of these inputs and assumptions in the model required a significant amount of management judgment and

is based upon a number of factors, including the selection of industry comparables, royalty rates, market growth rates and other relevant factors. Changes in

any number of these assumptions may have had a substantial impact on the estimated fair value of each element. These inputs and assumptions represent

management’s best estimate at the time of the transaction.

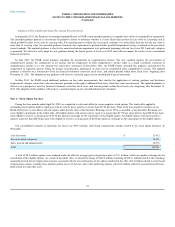

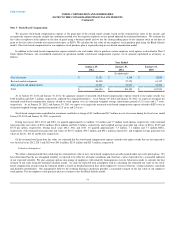

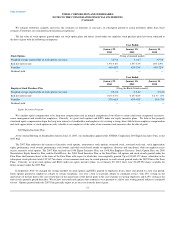

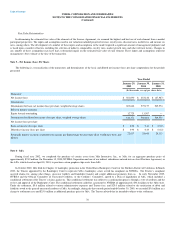

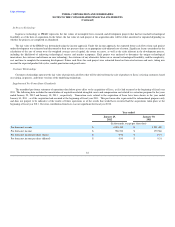

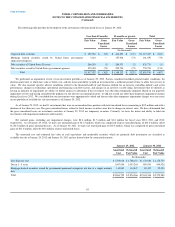

Note 5 – Net Income (Loss) Per Share

The following is a reconciliation of the numerators and denominators of the basic and diluted net income (loss) per share computations for the periods

presented:

Year Ended

January 29,

2012 January 30,

2011 January 31,

2010

(In thousands, except per share data)

Numerator:

Net income (loss) $ 581,090 $ 253,146 $ (67,987)

Denominator:

Denominator for basic net income (loss) per share, weighted average shares 603,646 575,177 549,574

Effect of dilutive securities:

Equity Awards outstanding 12,725 13,507 —

Denominator for diluted net income (loss) per share, weighted average shares 616,371 588,684 549,574

Net income (loss) per share:

Basic net income (loss) per share $ 0.96 $ 0.44 $ (0.12)

Diluted net income (loss) per share $ 0.94 $ 0.43 $ (0.12)

Potentially dilutive securities excluded from income per diluted share because their effect would have been anti-

dilutive

22,617 24,646 29,313

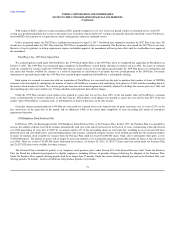

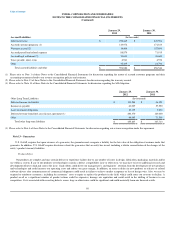

Note 6 - 3dfx

During fiscal year 2002, we completed the purchase of certain assets from 3dfx Interactive, Inc., or 3dfx, for an aggregate purchase price of

approximately $74.2 million. On December 15, 2000, NVIDIA Corporation and one of our indirect subsidiaries entered into an Asset Purchase Agreement, or

the APA, which closed on April 18, 2001, to purchase certain graphics chip assets from 3dfx.

In October 2002, 3dfx filed for Chapter 11 bankruptcy protection in the United States Bankruptcy Court for the Northern District of California. In March

2003, the Trustee appointed by the Bankruptcy Court to represent 3dfx’s bankruptcy estate served his complaint on NVIDIA. The Trustee’s complaint

asserted claims for, among other things, successor liability and fraudulent transfer and sought additional payments from us. In early November 2005,

NVIDIA and the Official Committee of Unsecured Creditors, or the Creditors’ Committee, agreed to a Plan of Liquidation of 3dfx, which included a

conditional settlement of the Trustee’s claims against us. This conditional settlement was subject to a confirmation process through a vote of creditors and the

review and approval of the Bankruptcy Court. The conditional settlement called for a payment by NVIDIA of approximately $30.6 million to the 3dfx estate.

Under the settlement, $5.6 million related to various administrative expenses and Trustee fees, and $25.0 million related to the satisfaction of debts and

liabilities owed to the general unsecured creditors of 3dfx. Accordingly, during the three month period ended October 30, 2005, we recorded $5.6 million as a

charge to settlement costs and $25.0 million as additional purchase price for 3dfx. The Trustee advised that he intended to object to the settlement.

78