NVIDIA 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

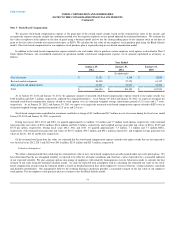

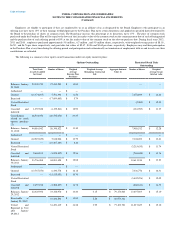

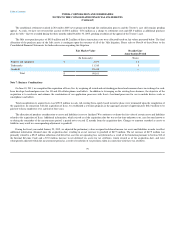

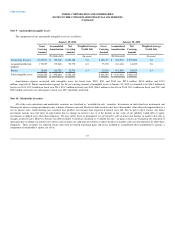

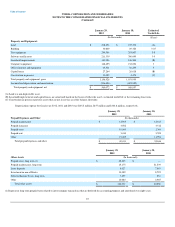

The preliminary fair values of the assets acquired and liabilities assumed by major class in the acquisition of Icera were recognized as follows (in

thousands):

Cash $ 3,315

Accounts receivable 13,740

Inventory 13,510

Prepaid and other current assets 1,972

Deferred tax assets 13,036

Property, plant and equipment 3,649

Goodwill 271,186

Intangible assets 97,515

Other assets 591

Total assets acquired 418,514

Accounts payable (6,026)

Accrued liabilities (38,735)

Notes payable (10,319)

Income taxes payable (4,558)

Deferred income tax liabilities (6,677)

Net assets acquired $ 352,199

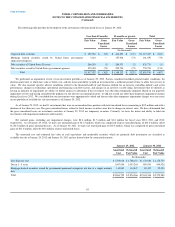

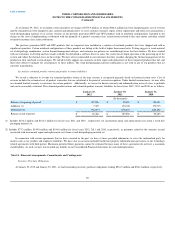

The goodwill amount of $271.2 million arising from the acquisition is primarily attributed to the assembled workforce of Icera and the premium paid

over the fair value of the net assets acquired from Icera. Goodwill recognized is not expected to be deductible for tax purposes. Please refer to Note 8 of

these Notes to Consolidated Financial Statements for further information regarding the activity related to the carrying value of goodwill.

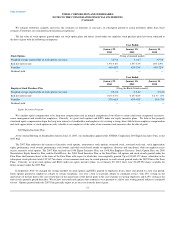

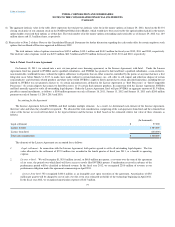

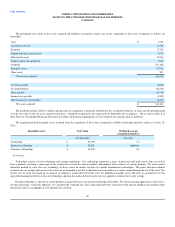

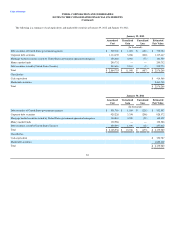

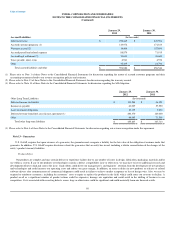

The acquisition-related intangible assets assumed from the acquisition of Icera were recognized as follows based upon their fair values as of June 10,

2011:

Intangible assets Fair Value Weighted-average

estimated useful lives

(In thousands) (In years)

Technology $ 58,300 7.4

In-process technology $ 20,200 indefinite

Customer relationships $ 18,200 6.8

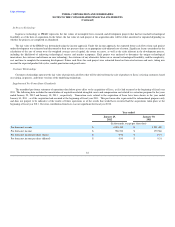

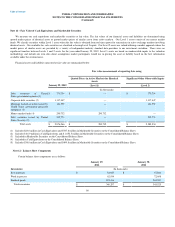

Technology

Technology consists of core technology and existing technology. Core technology represents a series of processes and trade secrets that are used in

Icera’s products and form a major part of the architecture of both the current products and planned future releases of current products. We used a profit

allocation method to value the core technology of Icera, based on market royalties for similar fundamental technologies. The profit allocation method

estimates the cost savings that accrue to the owner of an intangible asset that would otherwise be payable on revenues earned through the use of the asset. The

royalty rate we used was based on an analysis of empirical, market-derived royalty rates for guideline intangible assets. Revenue was projected over the

expected remaining useful life of the core technology and then the market-derived royalty rate was applied to estimate the royalty savings.

Existing technology is specific to certain products acquired that have also passed technological feasibility. We used an income approach to value Icera’s

existing technology. Using this approach, we calculated the estimated fair value using expected future cash flows from specific products discounted to their

net present values at an appropriate risk-adjusted rate of return.

80