NVIDIA 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

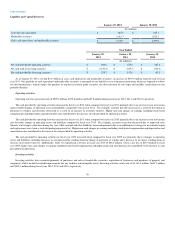

Inventories

Inventory cost is computed on an adjusted standard basis, which approximates actual cost on an average or first-in, first-out basis. Inventory costs consist

primarily of the cost of semiconductors purchased from subcontractors, including wafer fabrication, assembly, testing and packaging, manufacturing support

costs, including labor and overhead associated with such purchases, final test yield fallout, inventory provisions and shipping costs. We write down our

inventory to the lower of cost or estimated market value. Obsolete or unmarketable inventory is completely written off based upon assumptions about future

demand, future product purchase commitments, estimated manufacturing yield levels and market conditions. If actual market conditions are less favorable

than those projected by management, or if our current inventory or future product purchase commitments to our suppliers exceed our forecasted future

demand for such products, additional future inventory write-downs may be required that could adversely affect our operating results. Inventory reserves once

established are not reversed until the related inventory has been sold or scrapped. If actual market conditions are more favorable than expected and we sell

products that we have previously written down, our reported gross margin would be favorably impacted.

As of January 29, 2012, our inventory reserve was $110.1 million. As a percentage of our gross inventory balance, our inventory reserve has ranged

between 15.0% and 30.6% during fiscal years 2012 and 2011. As of January 29, 2012, our inventory reserve represented 24.4% of our gross inventory

balance.

Warranty Liabilities

Cost of revenue includes the estimated cost of product warranties that are calculated at the point of revenue recognition. Under limited circumstances, we

may offer an extended limited warranty to customers for certain products. Our products are complex and may contain defects or experience failures due to

any number of issues in design, fabrication, packaging, materials and/or use within a system. If any of our products or technologies contains a defect,

compatibility issue or other error, we may have to invest additional research and development efforts to find and correct the issue. Such efforts could divert

our management’s and engineers’ attention from the development of new products and technologies and could increase our operating costs and reduce our

gross margin. In addition, an error or defect in new products or releases or related software drivers after commencement of commercial shipments could result

in failure to achieve market acceptance or loss of design wins. Also, we may be required to reimburse customers, including our customers’ costs to repair or

replace products in the field. A product recall or a significant number of product returns could be expensive, damage our reputation and could result in the

shifting of business to our competitors. Costs associated with correcting defects, errors, bugs or other issues could be significant and could materially harm

our financial results.

As of January 29, 2012, we recorded a total cumulative net charge of $475.9 million, of which $466.4 million has been charged against cost of revenue

and the remainder has been charged to sales, general and administrative to cover customer warranty, repair, return, replacement and other costs arising from a

weak die/packaging material set in certain versions of our previous generation MCP and GPU products used in notebook configurations. Included in the

charge are the costs of implementing a settlement with the plaintiffs of a putative consumer class action lawsuit related to this same matter and other related

estimated consumer class action settlements.

Determining the amount of the warranty charges related to this issue required management to make estimates and judgments based on historical

experience, test data and various other assumptions including estimated field failure rates that we believe to be reasonable under the circumstances. The

results of these judgments formed the basis for our estimate of the total charge to cover anticipated customer warranty, repair, return and replacement and

other associated costs. However, if actual repair, return, replacement and other associated costs and/or actual field failure rates exceed our estimates, we may

be required to record additional reserves, which would increase our cost of revenue and materially harm our financial results.

Income Taxes

We recognize federal, state and foreign current tax liabilities or assets based on our estimate of taxes payable or refundable in the current fiscal year by

tax jurisdiction. We recognize federal, state and foreign deferred tax assets or liabilities, as appropriate, for our estimate of future tax effects attributable to

temporary differences and carryforwards; and we record a valuation allowance to reduce any deferred tax assets by the amount of any tax benefits that, based

on available evidence and judgment, are not expected to be realized.

United States income tax has not been provided on earnings of our non-U.S. subsidiaries to the extent that such earnings are considered to be indefinitely

reinvested.

41