NVIDIA 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

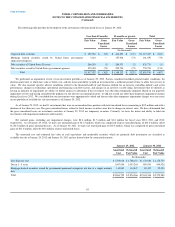

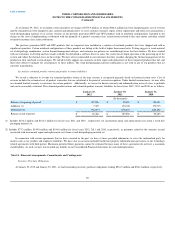

The conditional settlement reached in November 2005 never progressed through the confirmation process and the Trustee’s case still remains pending

appeal. As such, we have not reversed the accrual of $30.6 million - $5.6 million as a charge to settlement costs and $25.0 million as additional purchase

price for 3dfx – that we recorded during the three months ended October 30, 2005, pending resolution of the appeal of the Trustee’s case.

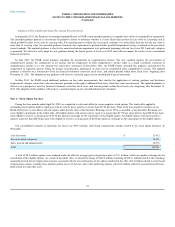

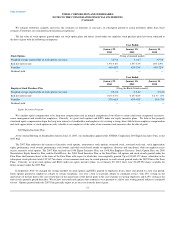

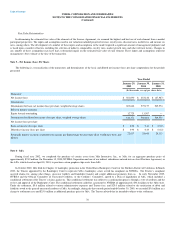

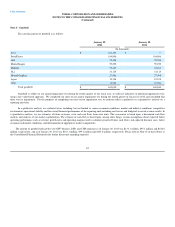

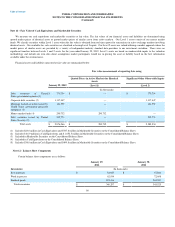

The 3dfx asset purchase price of $95.0 million and $4.2 million of direct transaction costs were allocated based on fair values presented below. The final

allocation of the purchase price of the 3dfx assets is contingent upon the outcome of all of the 3dfx litigation. Please refer to Note14 of these Notes to the

Consolidated Financial Statements for further discussion regarding this litigation.

Fair Market Value Straight-Line

Amortization Period

(In thousands) (Years)

Property and equipment $ 2,433 1-2

Trademarks 11,310 5

Goodwill 85,418 —

Total $ 99,161

Note 7: Business Combinations

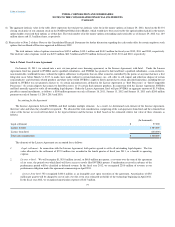

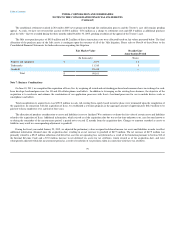

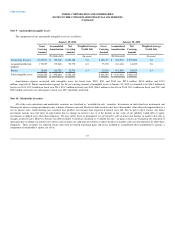

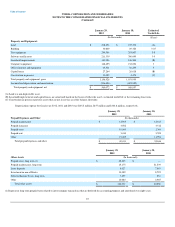

On June 10, 2011, we completed the acquisition of Icera, Inc. by acquiring all issued and outstanding preferred and common shares in exchange for cash.

Icera develops baseband processors for 3G and 4G cellular phones and tablets. In addition to leveraging on the existing Icera business, the objective of the

acquisition is to accelerate and enhance the combination of our application processor with Icera’s baseband processor for use in mobile devices such as

smartphones and tablets.

Total consideration to acquire Icera was $352.2 million in cash. All existing Icera equity based incentive plans were terminated upon the completion of

the acquisition. In connection with the acquisition of Icera, we established a retention program in the aggregate amount of approximately $68.0 million to be

paid out to Icera employees over a period of four years.

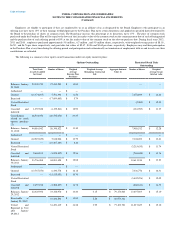

The allocation of purchase consideration to assets and liabilities is not yet finalized. We continue to evaluate the fair value of certain assets and liabilities

related to the acquisition of Icera. Additional information, which existed as of the acquisition date but was at that time unknown to us, may become known to

us during the remainder of the measurement period, a period not to exceed 12 months from the acquisition date. Changes to amounts recorded as assets or

liabilities may result in a corresponding adjustment to goodwill.

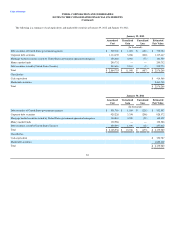

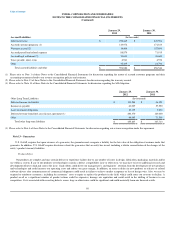

During the fiscal year ended January 29, 2012, we adjusted the preliminary values assigned to deferred income tax assets and liabilities in order to reflect

additional information obtained since the acquisition date, resulting in an net increase to goodwill of $47.5 million. The net increase of $47.5 million was

primarily related to a $54.5 million reduction of deferred tax asset for net operating loss carryforward as a result of the limitation pursuant to Section 382 of

the Internal Revenue Code and a $7.0 million increase to net deferred tax assets for tax attributes, which existed as of the acquisition date, and were

subsequently adjusted within the measurement period as a result of resolution of tax positions taken in connection with these tax attributes.

79